The rise of electronic payments in the mobile commerce industry is a no-brainer. In years since the retailing business began, there has been a drastic increase in the demand for digital transformation. This has further led to many technological advancements for various parts of the m-commerce industry such as mobile shopping, omnichannel experience, mobile advertising, augmented reality, voice user interface, and mobile payments.

For those who are unfamiliar with the mobile commerce concept– It is the buying and selling of goods and services via wireless handheld devices such as smartphones or tablets. In a nutshell, Mobile commerce is a variant of e-commerce development solutions that allows consumers to avail themselves of the opportunity of online shopping platforms such as Amazon, Myntra, Flipkart, etc., simply by tapping on their mobile screens.

Now with the increased usage of wireless online shopping experiences, one thing surely has a big part to play– The M-commerce payment technologies.

One of the most prominent centers of interest in the m-commerce industry is mobile payment solutions that offer convenience, security, and speed to complete transactions with just a tap of a finger.

There is not one but multiple mCommerce payment technologies available in the marketplace today! This blog covers it from head to toe!

Adoption of Mobile Payments in the m-Commerce Industry

Two factors ignited the consumer adoption of mobile payments. One is the absence of traditional retail outlets during the pandemic. Maybe a persistent distaste for constantly needing to carry cash accounted for the second. For many customers, mobile payments resolved the problem.

Some physical shop retailers got on board to be ahead of a potential new curve by installing physical terminals that provided consumers greater options in how they paid for products to accommodate shifting consumer expectations.

One lodging, for instance, has capture cameras aimed at the counter to swiftly obtain the bar codes for digital wallets. That tactic, meanwhile, didn’t work as well for all physical shop suppliers.

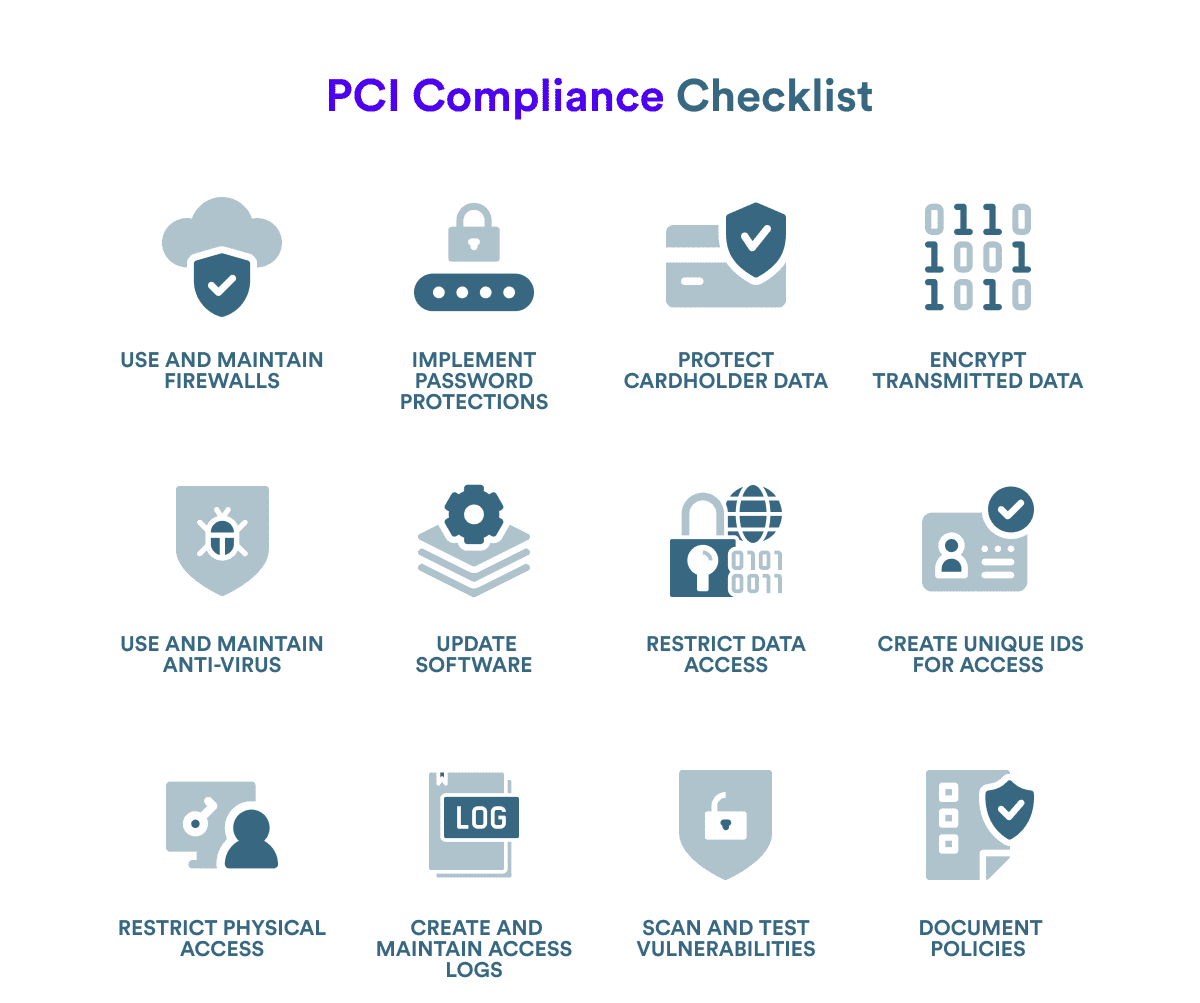

More complex solutions were needed to overcome other obstacles, such as bearing the expense of updating to more recent mobile payment systems. Making sure that the systems suppliers used complied with payment card industry (PCI) regulations was a more significant concern.

The possibility of Buy Now, Pay Later, or BNPL, which emerged during COVID-19, was a major factor in the shift to mobile payment methods.

“The ongoing expansion of mobile e-commerce is the cause of this rising demand for mobile payments. Snapp stated, “Statista estimates that by 2024 end, mobile e-commerce sales would have reached $2.5 trillion, or 60% of all e-commerce sales worldwide.

Let’s explore the types of mobile payments in the m-commerce market along with the list of payment technologies used in the industry!

Types of Mobile Payment Solutions & Technologies

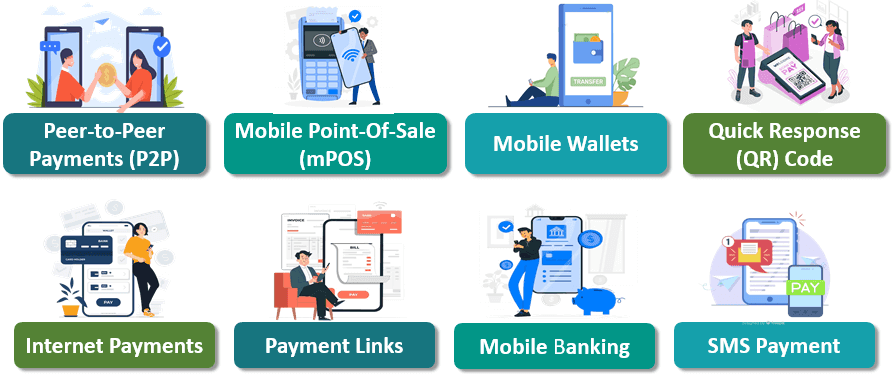

Numerous mobile payment solutions have emerged as a result of the surge in mobile app commerce crucial among startups and customers worldwide. Among the most popular categories of mobile payment options are:

1. Mobile Wallets:

These days, it is among the most widely used mobile payment options. Through the use of NFC (Near Field Communication), mobile wallets enable “tap-to-pay” functionality.

Alternatively, you may use an online wallet that has currency preloaded to make payments. The ease and speed with which mobile wallet payments may be made in comparison to cash payments is a major factor in their present appeal.

Among the most well-known mobile wallets available are:

- Apple Pay

- Samsung Pay

- Google Wallet.

2. Direct Mobile Billing:

In nations where carrier billing and postpaid plans are the norm, this type of billing has been widely adopted. Here, the purchase price is immediately applied to the customer’s cell bill when they make a purchase.

Here, the cost of a product is immediately applied to the customer’s cell bill when they make a purchase. Due to its popularity, this mobile payment option does not need the usage of credit or debit cards or online banking.

“If you wish to create a banking app for your business then click on the guide that provides hands-on expert experience and solutions to get the ball rolling.”

3. Using a Mobile Phone as a Credit Card Terminal:

It’s now possible to read credit cards on a mobile phone and make and receive payments. Small company owners are finding great benefits from this payment option since it is quick, safe, and eliminates the need for them to pay expensive EFTPOS machine fees. You can simply enable this service by plugging the credit card reader into the headphone jack. It currently supports Square and PayPal Here, among other services.

4. Mobile Web-based Payment:

With this type of mobile payment, the user accesses websites, the internet, or any installed application on their phone. Wireless Application Protocol is the underlying technology utilized for these types of payments (WAP).

Many mobile network providers are already using this technique; the PayPal app offers one of the most well-known services under the moniker PayPal Quick Checkout. Additionally, businesses are increasingly integrating source to pay solutions to streamline mobile transactions and ensure efficient financial operations

5. Mobile Point-of-Sale (mPOS) Systems For Flexible Merchant Services

mPOS systems, which enable mobile payments and turn smartphones or tablets into fully functional point-of-sale (POS) devices, are a boom for small and mid-sized enterprises. With mobile financial services, this flexibility enhances company operations by enabling merchants to take payments while on the go and makes it simpler than ever to accommodate client payment preferences.

6. Biometric Authentication For Enhanced Security

Biometric authentication technology is being used by mobile payment systems more and more to improve security and foster user confidence. Users may conveniently and securely authorize payments using smart devices that have iris scanners, face recognition software, or fingerprint sensors. Biometric authentication lessens the need for conventional PINs, passwords, or signatures by providing an additional layer of security against fraud and identity theft.

Companies can guarantee safer transactions and a seamless user experience by integrating biometric authentication with their mobile payment systems. We may anticipate further innovation and broad acceptance in the field of mobile commerce as biometric technology develops.

7. Effortless Augmented Reality Integration

The integration of augmented reality with mobile commerce is revolutionizing the way people purchase and make decisions about what to buy. Augmented reality has been gaining pace in several sectors. By enabling customers to visually try on things, see furniture in their homes, and explore immersive product catalogs, retailers are utilizing augmented reality (AR) to improve the online shopping experience.

By incorporating augmented reality (AR) technology into mobile payment systems, consumers may make rapid, well-informed decisions about what to buy, which lowers the chance of cart abandonment. Businesses that embrace this trend will gain a competitive edge and attract tech-savvy clients as consumers get increasingly used to augmented reality experiences.

Popular M-commerce Apps Using Payment Technologies In 2024

Online purchases are made possible via m-commerce applications and solutions, which are referred to be the next generation of e-commerce stores. The Wireless Application Protocol is the foundation of the new technology behind mobile commerce (WAP). Payments may be made with m-commerce applications in some businesses, including retail, banking, hospitality, and airlines. Several well-liked categories of m-commerce solutions consist of:

Applications for Ticket Sales

Customers may purchase tickets for movies, events, concerts, sporting events, and more using ticket applications. The user of the app may examine a variety of events, as well as their location, performance times, available amenities, and even the ability to resell tickets.

A few of the ticket sales apps include:

- Eventbrite

- ThunderTix

- Eventzilla Corporation

- Blackbaud altru logo

- Korona pos logo

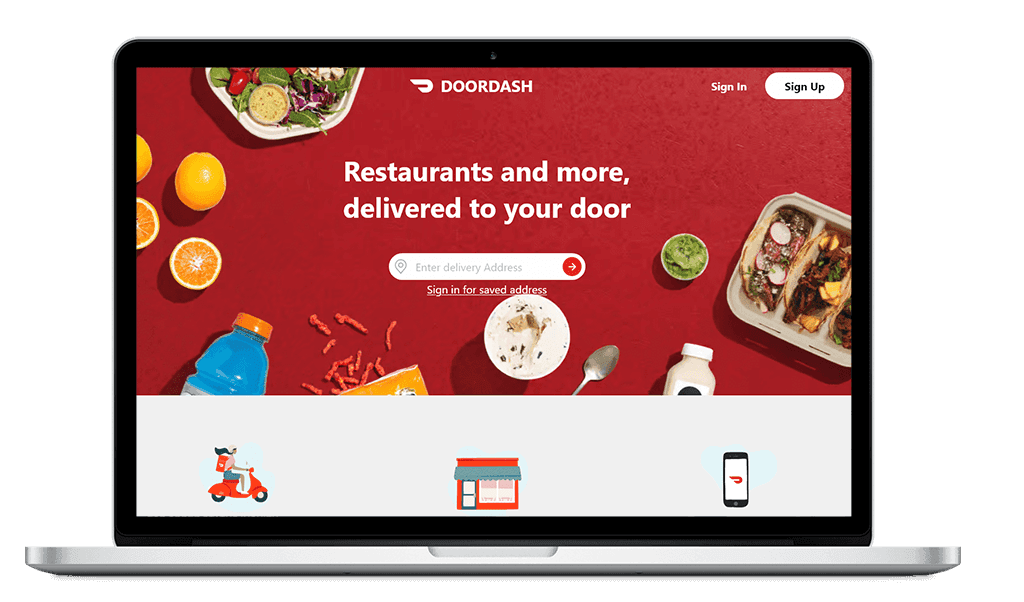

Restaurant Booking & Food Delivery Apps

These applications are mostly used for making restaurant reservations with pre-selected meals or ordering a whole meal with just the phone. Since businesses like Uber Eats and others have found success in the mobile area, the professional hospitality sector has also begun to make inroads into this rapidly expanding domain.

Some days, some applications also give freebies, free meals, or discounts to loyal users, which increases their appeal.

Mobile Concierge & Personalized Recommendation Apps

These apps allow mobile users to look up theaters, retail centers, eateries, lounge bars, etc. A customized channel that may be kept and modified at a later time is also available to each user.

Many applications also allow users to customize suggestions based on their tastes and geography, allowing them to get recommendations tailored to their specific area.

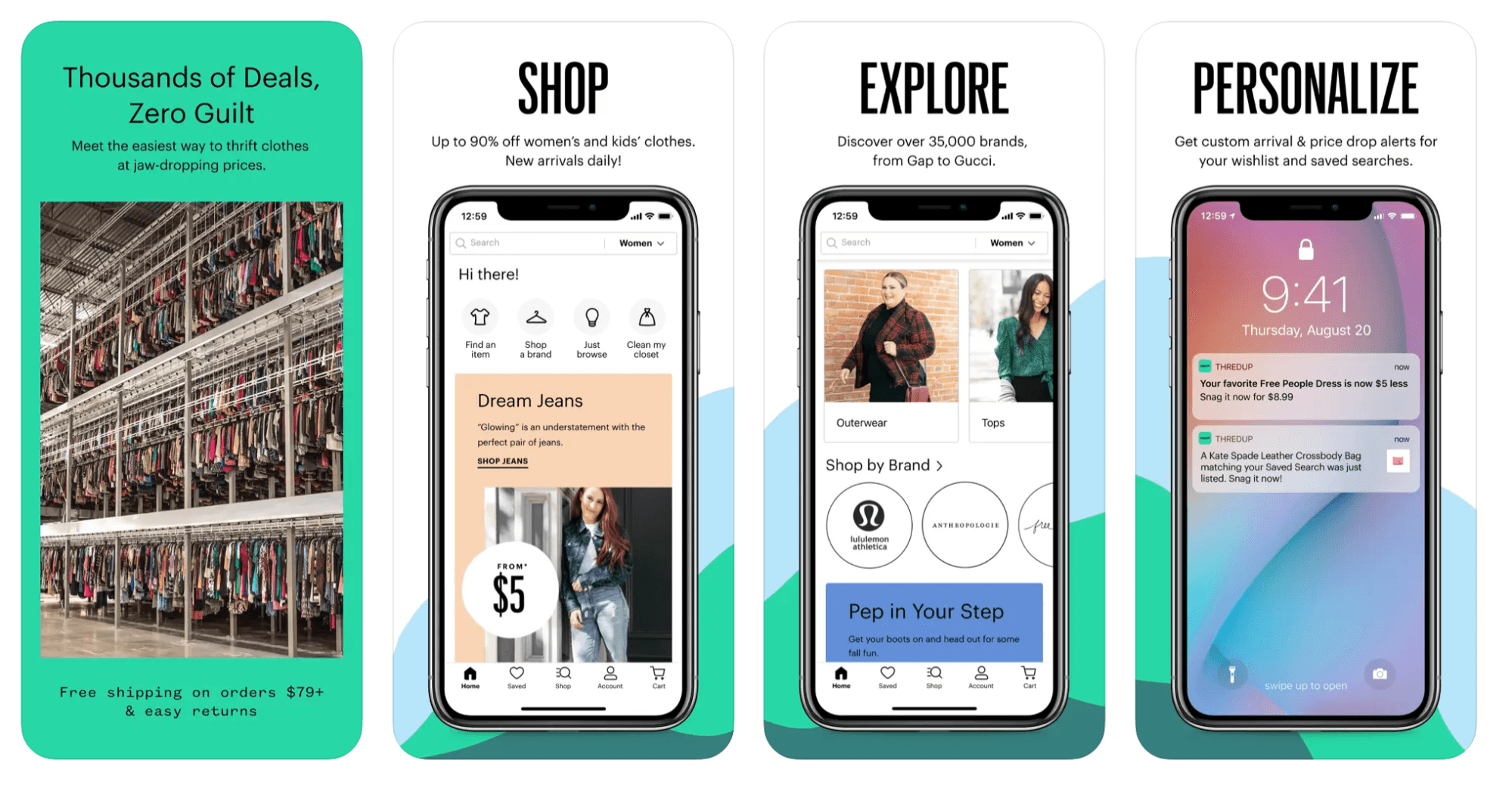

M-commerce Marketing Apps

These applications are designed from the bottom up to provide marketing assistance for certain goods or services. While some serve as an aggregator for various discounts and offers from various e-commerce platforms, enabling users to explore deals and make purchases from a single convenient location, they often provide clients with a carefully selected community of companies to pick from. Several popular applications are –

- Magento 2 Mobile App Builder

- Shopney

- Shopify

- WooCommerce

Continue reading about Magento, Shopify, and WooCommerce in detail to find the best e-commerce platforms.

Retail Store Apps

Nowadays, the majority of retail establishments have m-commerce applications that allow customers to purchase products using only their phones. Some of the apps may be also tailored for tablets, which can provide the advantage of using larger screens.

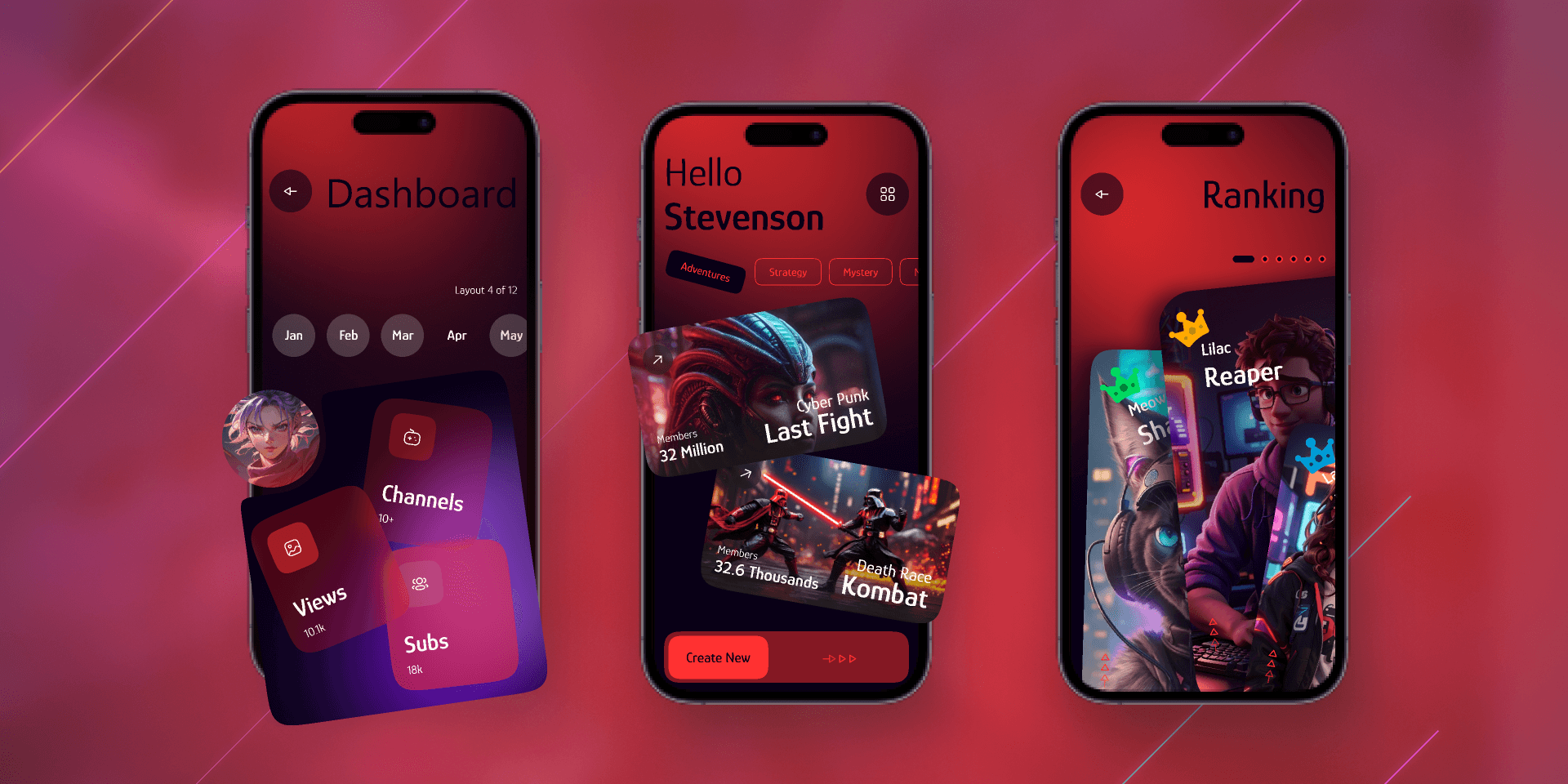

Social & Gaming Apps

A growing number of m-commerce features, such as in-app purchases and integrated payment systems, are being added to mobile gaming apps. Mobile games make money by allowing users to buy virtual currency with common payment methods. These games provide rapid access to millions of players when they are built on social networking apps.

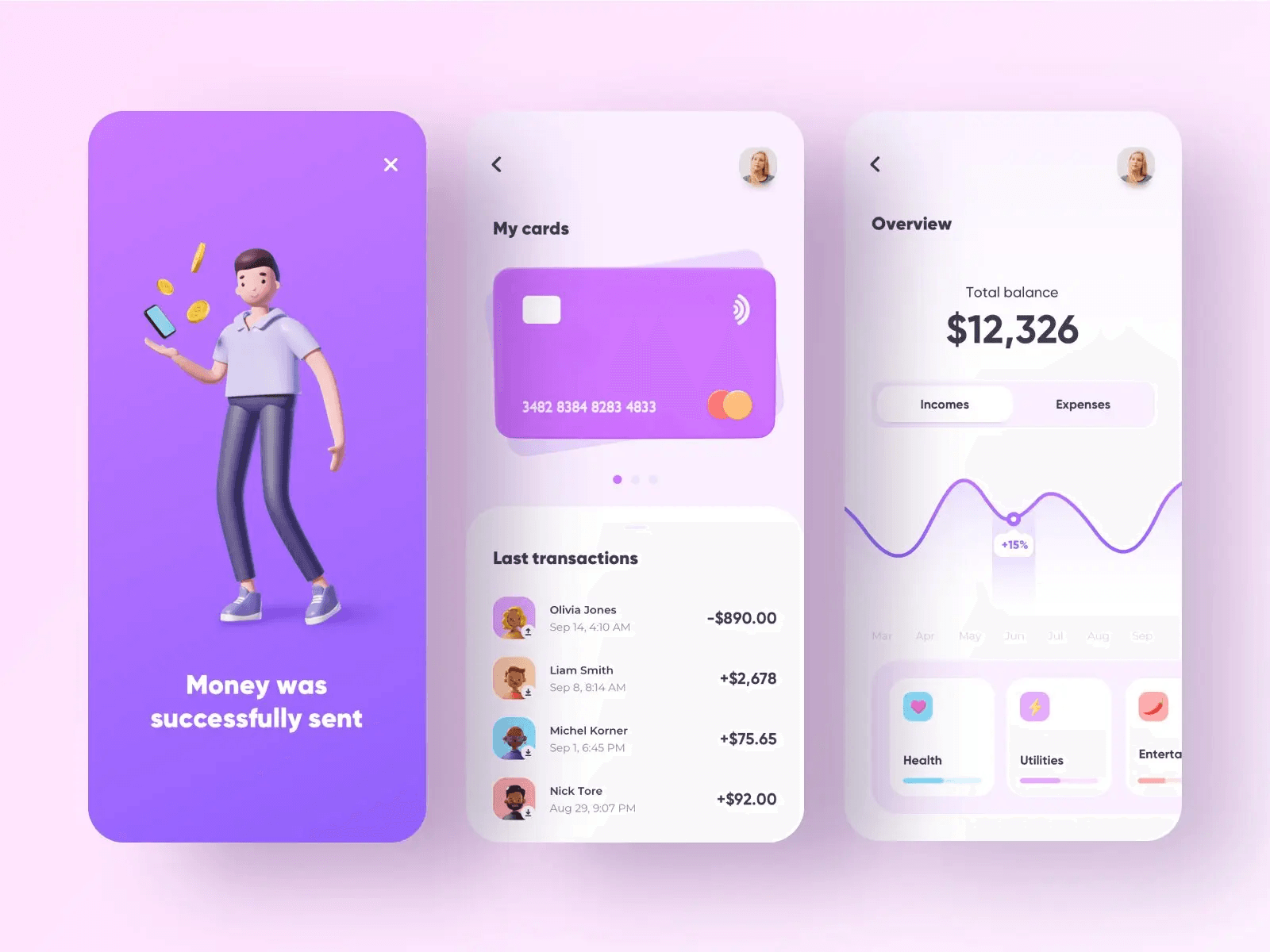

Banking Apps

Nowadays, mobile consumers are using banking applications more and more frequently. Through a specialized, highly secure app, the majority of banks provide their customers with standard banking services. Like credit card payments, bill payments, mobile access to finance and accounting services, etc. These days, real-time notifications and information about account transactions, daily statements. And other updates are also sent to users through banking applications.

Final Thoughts

Companies must take advantage of the rapidly expanding m-commerce market and the growing income from mobile payments. For over 6 plus years, DianApps has been offering e-commerce development services to clients all over the world.

Our dedicated mobile app development company is apt at creating applications for various operating systems. Here are a few of the projects we have worked on.

Get in touch to share your ideas with us if you need any m-commerce. Or mobile payment solutions, and we will respond to you within a day.

Leave a Comment

Your email address will not be published. Required fields are marked *