Financial transactions and services as a whole have shifted to digital ways for a very long time. However, mobile-based transactions and payment transfers are the most popular among them. A survey reveals that the share of smartphone users in 2023 covers almost 87% of the world’s population having a smartphone.

Considering the wide adoption of smartphones and many sporting financial apps, people are becoming more tech-savvy in terms of communication and managing finances.

While many fintech apps are already ruling over the market, we can still see new apps penetrating and building space for themselves.

The Fintech apps have provided an alternate option to financial institutions for building meaningful customer relationships by streamlining the finance services backed with digital technologies.

If you also have a Fintech app idea that has the potential to tap the untouched banking and financial services, then it’s time to develop an app. Here’s your guide to know about trends, features, and insights.

Statistical Insights about the Fintech App Development Industry

According to Vantage’s market research, the global fintech market is expected to grow significantly, reaching about $133.84 billion in 2022 and skyrocketing to $556.8 billion by 2030. This growth is estimated to have a compound annual growth rate (CAGR) of 19.5%.

Similarly, Allied Market Research projects that the worldwide fintech technologies market will hit a substantial figure of $698.48 billion by 2030, with an anticipated CAGR of 20.3% throughout the 2020s. Fintech’s rise is attributed to its adept use of cutting-edge technologies and user-friendly features, making banking and financial services more convenient.

Statista’s data further supports this growth, highlighting digital investment as the leading category within fintech, with transactions totaling nearly $112.90 billion expected in 2023. By the same year, the global user base for digital payment solutions is projected to reach 5.62 billion, growing to an impressive 7 billion users by 2027.

Overall, these statistics underline the rapid expansion of fintech, driven by increasing user adoption and the integration of innovative technologies, ultimately reshaping the finance vertical for greater convenience and accessibility.

Must-have Features in Fintech Applications:

Account Management

Banks differentiate their services by offering personalized account management pages, empowering users to tailor their interface according to individual preferences. This enables effortless money transfers, real-time activity tracking, and expenditure monitoring, all while conveniently checking account balances. By integrating such features, users gain autonomy and efficiency within the app, reducing reliance on traditional online banking platforms for day-to-day financial management tasks. This tailored experience enhances user engagement and satisfaction, setting the bank apart in the competitive fintech domain.

Digital Payments

In the automation-centered age, mobile banking apps prioritize digital payment features, granting users swift access to diverse methods like UPI and mobile wallets. This facilitates seamless account management, recurring payments, and bill settlements. Automatic deductions for regular payments enhance convenience, alleviating users from remembering payment deadlines. Moreover, such FinTech apps liberate users from bank visits, empowering them to conduct transactions and monitor accounts conveniently from anywhere, ensuring flexibility and efficiency in financial management.

Language Options

Fintech apps prioritize offering a diverse array of language options to cater to global users, fostering accessibility and usability. By allowing users to interact in their native language regardless of geographical location, these apps enhance convenience and user experience worldwide. Moreover, diverse language offerings signify a commitment to inclusivity and diversity, demonstrating the company’s dedication to serving all community members. Language customization is integral to fintech software, showcasing providers’ efforts to adapt to diverse user needs and ensuring that every individual can seamlessly engage with financial services, thus promoting inclusivity, diversity, and user satisfaction on a global scale.

Customer Support

Providing comprehensive customer support via email, phone, and online chat is crucial for addressing bugs and issues in financial apps promptly. Offering responsive assistance ensures users receive timely help, enhancing their overall experience and trust in the app’s reliability and support system.

Bill Payment

With fintech app developmnet services streamline bill payment, consolidating expense management into a single platform. This efficiency saves time and money, enabling users to settle bills, circumvent in-person visits, and even mail checks from one location. By ensuring timely payments, the feature aids users in sidestepping late fees and safeguarding their credit scores, thus reinforcing financial discipline and enhancing overall financial well-being.

Money Transfer

With financial technology applications, you can conduct peer-to-peer money transfers seamlessly, allowing users to send and receive funds digitally without the need for physical currency or checks. Additionally, businesses benefit from the convenience of easily paying suppliers or vendors through the app, streamlining financial transactions and enhancing efficiency in commercial operations.

ATM Locator

ATM locators play a crucial role in financial apps by offering customers easy access to nearby ATMs for cash withdrawals. This functionality ensures swift and convenient access to funds when needed, enhancing overall user convenience. Moreover, by enabling users to locate ATMs in familiar and safe areas, the feature contributes to user safety, mitigating risks associated with unfamiliar locales. In essence, ATM locators are indispensable components of financial apps, empowering users to manage their finances effectively and make informed decisions by providing access to essential banking services wherever they go.

Intuitive Interface and Ease of Navigation

The application’s user interface must prioritize simplicity and ease of use to prevent user frustration and abandonment. Offering voice search, typed query options, and intelligent shortcuts to commonly used features enhances user navigation. The app promotes user engagement and satisfaction by ensuring intuitive design and clear navigational guidance, ultimately improving the overall user experience and retention rates.

Rewards and Incentives

Rewards and incentives serve as powerful motivators within fintech apps, encouraging user engagement and financial activity. By offering awards, bonuses, or points for completing specific tasks or reaching milestones, users are incentivized to interact with the app and conduct transactions. This feature not only boosts user involvement but also fosters loyalty and satisfaction, driving continued usage and fostering a positive relationship between users and the app.

Security

To protect user data, a fintech app must have sound security functions like two-factor authentication, data encryption, and biometric authentication (fingerprint scanning and facial recognition). A fintech app’s features help make sure that only users who have permission may access it and all other financial data.

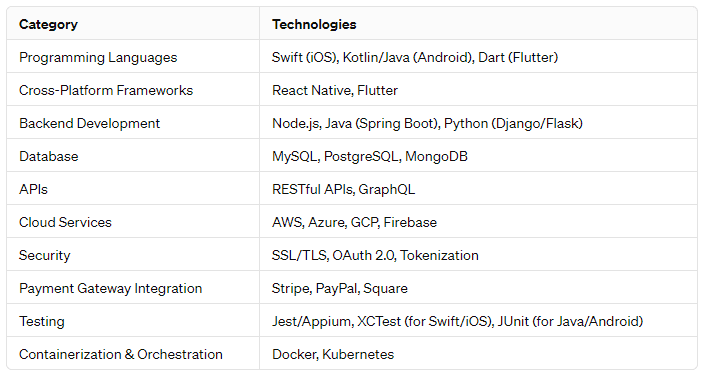

Tech Stack Used In Fintech App Development

Fintech software development services demand a careful assortment of technologies to guarantee security, scalability, and a seamless user experience. The following table will give a clear picture of the technologies.

For more details, you might also want to read the Best Tech Stack For FinTech Software Development in 2024

Fintech App Development Trends 2024

Embedded Finance

According to Dealroom analysis, embedded finance is forecasted to reach a $7.2 trillion market value by 2030, surpassing both fintech startups and the top 30 global banks and insurance firms combined. This trend involves seamlessly integrating financial services into non-financial platforms, breaking down industry silos, and offering users convenient access to financial functionalities. Examples include interest-free loans at online checkouts, user-friendly one-click payment apps, and branded checking accounts. Embedded finance facilitates accessibility and enhances user experience by incorporating financial services into everyday activities.

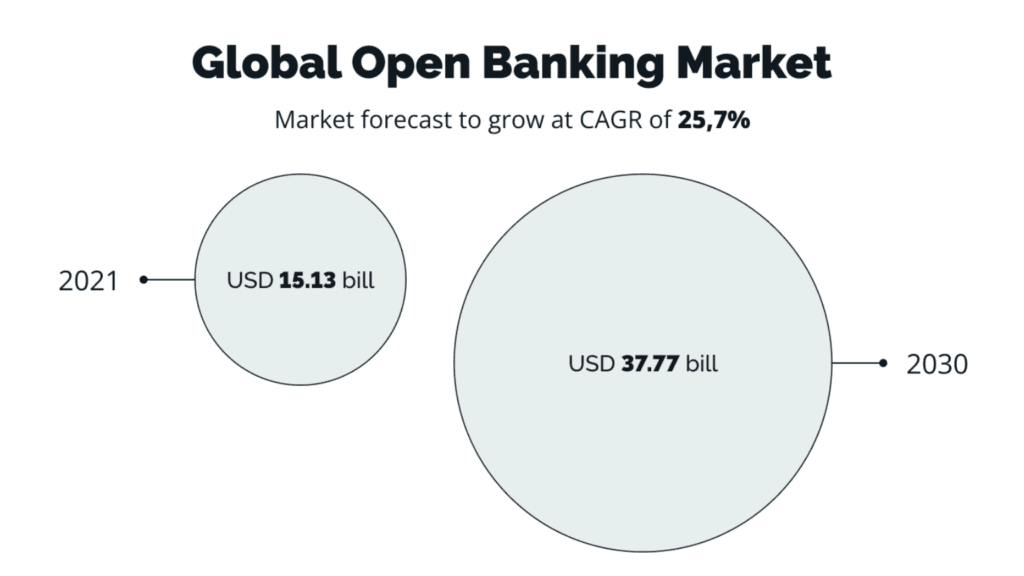

Open Banking

Open banking, predicted to reach 63.8 million users by 2024, facilitates controlled sharing of financial data through accessible APIs. This trend empowers third-party fintech providers to offer various services like budgeting, lending, and financial planning. Despite only 10% of its potential realized, open banking fosters innovation, transparency, and competition in financial services, leading to lower loan rates and improved customer experiences through streamlined transactions and enhanced data analysis capabilities.

Neobanking

The pandemic catalyzed the rise of FinTech, particularly in the form of neo-banks, which mimic traditional banks but lack physical branches. These digital-only banks offer cost-effective and convenient banking solutions, attracting millions of customers globally. Chime, a prominent neo-bank in the US, boasts over 13 million users, offering essential banking services and a user-friendly interface. With projections indicating a customer base surge to 360 million by 2026, neo-banks represent a significant trend reshaping the financial sector towards digitalization and accessibility.

RegTech (Regulatory technology)

Financial institutions must comply with regulations by maintaining accurate accounting and customer records, and submitting necessary paperwork to regulatory agencies according to schedules. RegTech, a trend in fintech for 2024, aids in regulatory compliance by automating processes, enhancing data security, and detecting fraudulent activities. Failure to comply can lead to substantial penalties, as seen in Bank of America’s $42 million fine. RegTech facilitates seamless communication with regulatory authorities, ensuring compliance, and tracking financial crimes effectively.

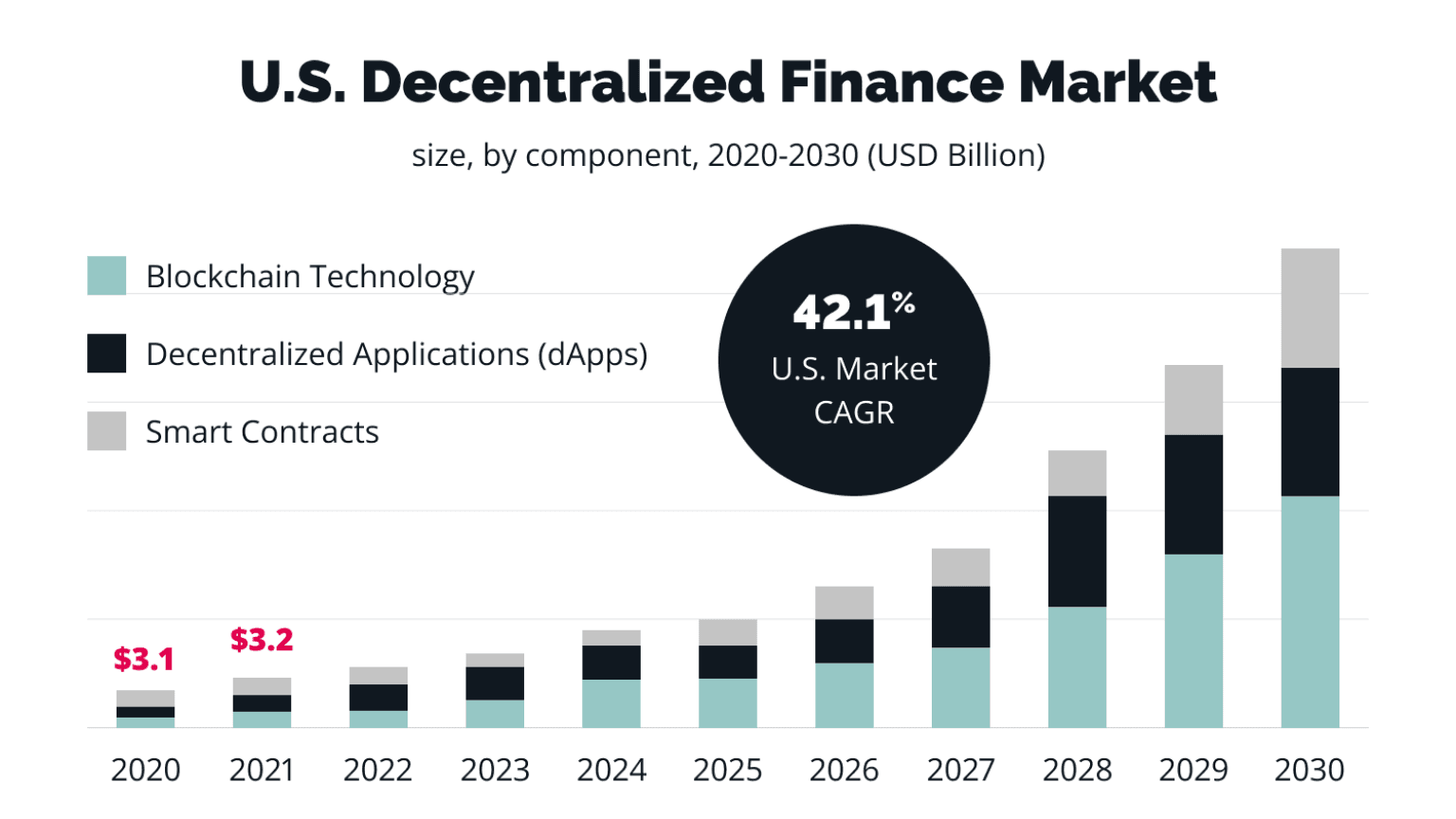

Decentralized Finance

DeFi, a rising fintech trend for 2024, includes decentralized financial products like loans, exchanges, and payment apps, operating without central authorities. Utilizing self-executing smart contracts and open-source protocols, DeFi enhances user confidence and facilitates seamless interaction among multiple blockchains. This innovation democratizes finance, competing with centralized solutions and broadening cryptocurrency accessibility to a wider audience.

Green Banking

Green banking is when banks and financial companies focus on being environmentally friendly. Many people now care more about the environment, so banks are starting to offer services that help the planet. Some banks are using digital payments because they’re better for the environment than using cash or cards. They’re also trying to reduce their own environmental impact by things like using less energy and creating less waste. People like this, so they’re more likely to choose eco-friendly banks.

AI & ML Development

The global AI in fintech market is projected to reach $26.67 billion by 2026, with over 90% of fintech firms leveraging AI and machine learning extensively. AI enables personalized financial services by analyzing customer data, reducing fraud investigation workload by 20%. Chatbots and digital assistants enhance user interactions, while UBS Group exemplifies AI’s potential through premium banking services. Robo-advisors are notably gaining traction in the industry.

Robo-Advisors

The emergence of AI-driven robo-advisors revolutionizes financial advising by offering personalized guidance to investors. These applications analyze vast datasets, adapt rapidly to market changes, and recommend optimal investment strategies based on individual objectives. Particularly beneficial for novice investors, robo-advisors democratize investing by lowering entry barriers and enabling profitable opportunities even with limited capital.

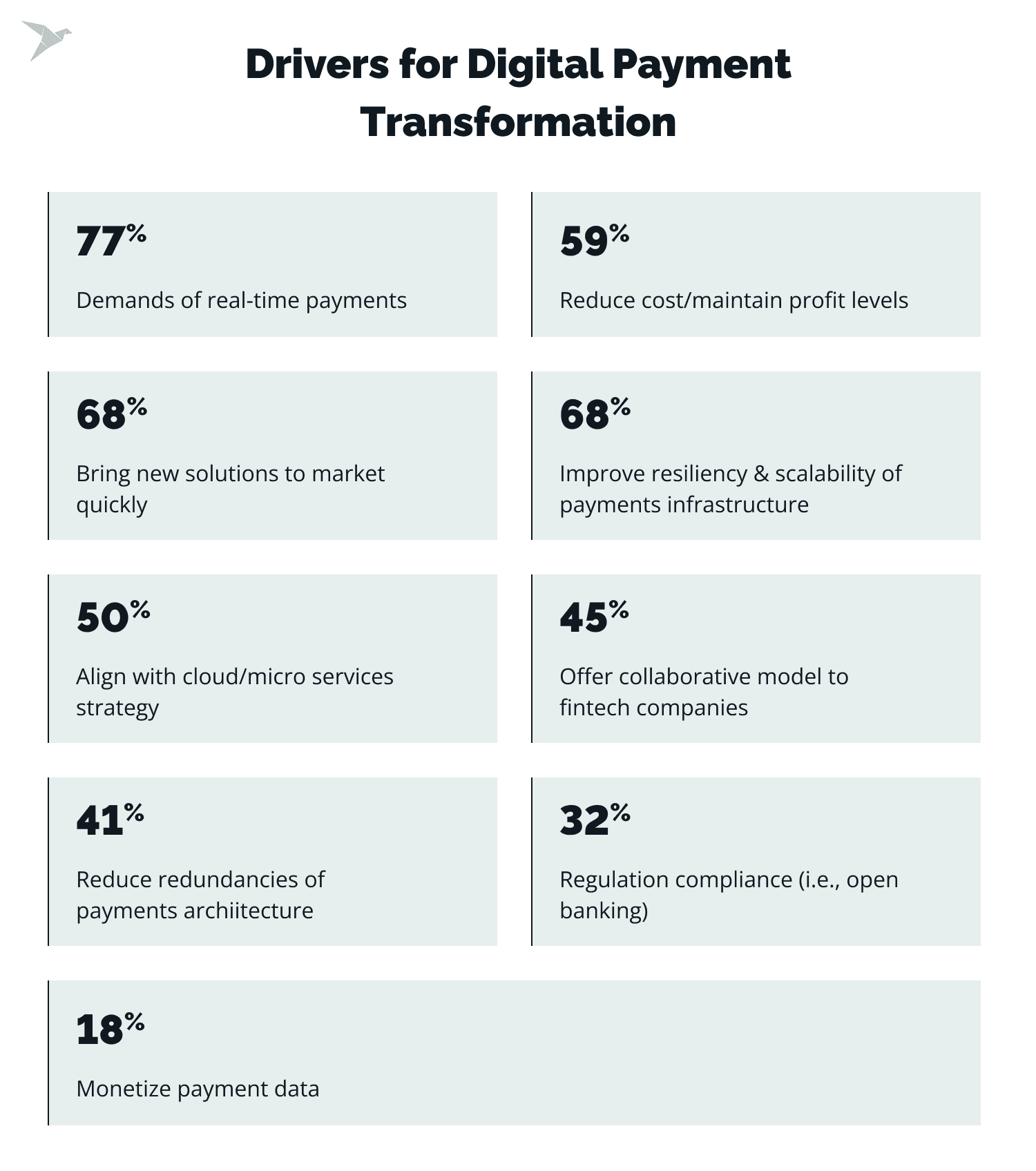

Payment Gateways

The whopping demand for online transactions underscores the necessity of robust payment gateways, facilitating seamless bank-to-bank transactions between clients and retailers. Valued at $17.2 billion presently, this market is projected to reach $42.9 billion by 2025. Simplification of payment stacks emerges as a key trend in fintech for 2024, addressing issues like limited payment methods and high commissions. Payoneer exemplifies this trend, offering a universal payment system across 200 countries and enabling partnerships with global banks and businesses like Airbnb and Univera. This showcases the importance of fintech companies partnering with international clients for market expansion.

Biometric Authentication

The demand for secure and convenient identity verification in financial services is driving the adoption of biometric authentication technologies in the fintech industry. With 81% of consumers prioritizing rapid and secure authentication experiences, biometrics offer a reliable solution. Market projections indicate significant growth, with the global biometrics market expected to reach $68.6 billion by 2025. Fintech companies are increasingly investing in biometric solutions to enhance security and efficiency, addressing consumer concerns and staying ahead of cyber threats. Companies like IDcheck provide advanced biometric verification technologies, ensuring secure and seamless identity verification for financial services, including document verification and KYC processes.

How Much Does It Cost To Build A FinTech App?

The cost of developing a FinTech app varies depending on factors such as complexity, required features, development platform, and team location. Basic apps may cost less, while those with advanced features can range from $50,000 to $500,000 or more. Additionally, factors like maintenance, support, marketing, and updates should be considered, as technology evolves and user needs grow. mobile app development companies with consulting experience for detailed project proposals including scope, timeline, and costs is advisable for accurate estimates.

Partner with DianApps for all your Fintech App Development Needs

Developing a fintech application in 2024 requires a thorough understanding of the features to be integrated, trends and practices to be followed, and technologies to be used. If you’re already overwhelmed by this thought and need guidance, DianApps has all the expertise that is required to optimally use cutting-edge tech stack aligning with your business objectives. We never limit ourselves and keep on expanding our knowledge while honing our skills while working on clients’ projects. We have worked on payment-integrated solutions to money lending apps, Fintech CRM, digital wallets, and others.

With our hands-on experience in custom software development services, you can rest assured regarding the consultation, ideation, development, and the entire process till the launch and further support. So why wait? Contact us now!

Leave a Comment

Your email address will not be published. Required fields are marked *