In the US market, 92.1% of the people have insurance, to save themselves from the uncertain financial burdens. Reductions in the life expectancy rate have also given rise to the need for insurance companies.

But, ever come across a situation where you are trying to get detailed information on the insurance policies via websites but, none of the agents are calling you? Well, this was the condition of the insurance companies before an innovation of the digital world.

Significant rise in the insurtech and the demand for insurance mobile app development services have expanded the need for established insurance companies to build insurance mobile apps. These apps not only provide insurance services but also enhance user experience and client conversion rates.

Your decision to develop an insurance app can be affected by multiple factors like the cost, benefits, and the process of development. Well, in this blog we will cover all these aspects and take you through the features and the benefits of considering your idea of insurance mobile app development.

Let’s get a deep insights into this blog,

What do You Understand by Mobile Insurance App?

Insurance apps are considered a bridge between the insurance company and policyholders. These platforms are built to provide services like payment procedures, claim management, policy management, and more. However, insurance apps allow companies to provide customer service, potentially reach new markets, and improve efficiency. Insurance apps are highly beneficial to increasing business revenue. Fintech App Development Company like DianApps can help you hire expert developers.

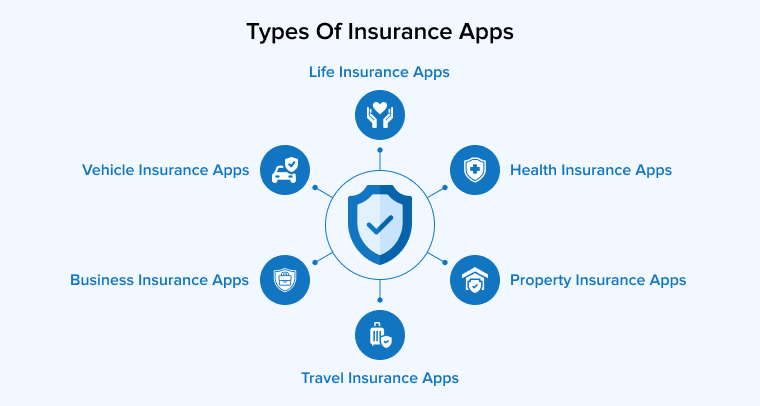

Different Types of Insurance Apps

Each type of insurance app varies with features and functionalities. So. to build an application based on your targeted niche learn about all six types of insurance apps:

Life Insurance

Life insurance is one of the most used insurance types, as these days every person wants to cover their life and disability. With the help of these insurance apps, customers can easily compare policies, premiums, and the benefits of the plan. Moreover, you can also make payments through these apps, and receive notifications.

Health Insurance Apps

Health insurance apps are designed to manage the health policies of the customers and view policy details. These apps consist of various features like appointment booking, selecting preferred doctors, searching for suitable health plans, virtual healthcare services, and comparing rates of doctors.

Read How to Build a Secure and User-Friendly Medical Insurance App.

Property Insurance Apps

Property insurance is not only for homes, it includes various aspects like real estate, artwork, expensive equipment, jewelry, and many others. These apps allow you to choose policies based on your preferences, set property maintenance reminders, filing claims.

Travel Insurance Apps

Travel insurance is helpful to stay safe during travels and it covers all the risks and uncertainties that can happen during travel. This insurance covers unexpected medical expenses, accident & sickness, trip cancellation, loss of travel documents, and more.

Business Insurance Apps

Various commercial coverage can be covered under these insurance like workers, liability, and property. Here, you can get an option to select from various policies as per your business size & nature of risk.

Vehicle Insurance Apps

In the vehicle insurance apps vehicles like bikes, cars, autos, trucks, and buses, can be covered under insurance. We get access to multiple features like payment options, submitting claims, policy comparisons, and more. Taking claims with insurance apps becomes easier as in case of accidents it allows you to capture an image of the accident spot, and provide a repair estimate.

Why You Should Invest in Insurance App Development?

The increase in digitalization has also expanded the need for insurance apps, as it enhances the smooth communication between users and insurance companies. Both business owners and users find insurance apps beneficial for them. Let’s look at a separate both for both insurance companies & clients.

Benefits to Insurance Companies

Here are the points that make insurance apps beneficial for insurance companies:

Improved Customer Communication

With the innovation of insurance apps, the communication bridge between companies and customers has been reduced, and now it enables effective communication. In case of any queries, you can get 24*7 chatbot assistance, which also helps to reduce the agent’s workload.

Streamlined Operations

Now most of the tasks can be automated like processing claims and generating quotes. This reduces the manual task of the customers. Reduced burden of the companies can lead to efficient operation management.

Customized Customer Offerings

Insurance apps help provide personalized recommendations to customers by collecting data from these apps and analyzing them based on customer preferences. This feature enhances customer satisfaction and retention rates.

Data-Driven Insights

Data collection related to customer interests, behaviors, preferences, and needs through mobile apps can be beneficial to provide personalized solutions and bring new products and services.

Enhances Productivity & Sales

Operational productivity of the insurance businesses can be increased, with the existence of mobile apps as, it reduces the manual tasks of the employees. It also enhances customer satisfaction which leads to an increase in client conversion.

Rapid Customer Feedback

For the success of the business, feedback collection is one of the most important aspects. Mobile apps can easily allow you to collect feedback related to new products or services and to identify what the customers are actually for.

Benefits to Users

The innovation of mobile apps has enhanced the user experience. Read further to learn about the benefits of insurance mobile app development.

Multiple Insurance Access

Manual consultation with the agents can help you access only 3-4 policies, now with insurance apps, you can easily get access to multiple policies without moving from one place to another. This process has eliminated the role of manual visits and in-person communication.

Policy Verification

Through an insurance mobile app, you can easily check the documentation required to take an insurance plan and the factors that will be covered under a specific policy. This helps build company authentication and user satisfaction.

Convenient Virtual Consultations

Mobile apps can be considered beneficial for you if you need help regarding consultation, insurance expenses, and policy. This process will eliminate the need for booking in-person appointments as it will provide professional advice and guidance.

Timely Renewal Reminders

The personalized reminder is the best system, as it reminds clients and agents regarding the policy renewable deadlines or updates. This feature will prevent customers from policy lapse.

Mobile-Friendly Documentation

Nowadays, people can easily fill out any forms related to issue policy via smartphones or tablets. Be it a policy renewable form, payments, or any other you can easily fill it by yourself without any complexity. This process ensures a transparent documentation system between customers and agents.

Real-time Updates

Push notification is a system provided in the insurance apps to keep the customers updated with the latest updates, benefits, and available discounts. This ensures users to stay updated.

There is a list of benefits to having a mobile app for your business.

Features Required to Build a Mobile Insurance App

Insurance companies’ operations can be streamlined and customer satisfaction can be enhanced if an insurance app is well-defined and consists of all the necessary features. Below is the list of the essential features that should be included while developing an application:

User Registration and Profile Management

First-time app users must get a notification to register on the mobile apps, and the registration process must be easily understandable for these users. Once the users are registered on the app allow them to store and manage their personal information accordingly. Moreover, this feature also allows users to access their policies and manage them directly through the app.

Policy Management

Insurance must provide users with complete information related to their ongoing policies, like maturity date and time, access to easily download documents, coverage details, and more. They must also be able to pay premiums and automate payment systems. These features can easily increase user satisfaction and loyalty towards the app.

Policy Recommendations and Quotes

Insurance apps must provide personalized information to the customers related to the policies and they must also provide notification to the users related to new insurance policies. Users can also get quotes based on the information and preferences tey have entered.

Payment Gateway Processing

This is one of the most important features because everyone wants to pay the bill online without having to follow the long process of an agent These apps should support multiple processes pay employing debit cards, credit cards, net banking, digital wallets, etc., providing a smooth and convenient payment experience

Claims Processing

In the earlier days, customers had to run after the agents to get claims, but an innovation of insurance apps has simplified the process and improved user experience. So, the insurance app must have a feature to apply for claims, upload documents, and track the real-time status of claims. This process can save agents from the hassle and provide claims with a few simple steps.

Customer Support

Some important communication systems like live chat support, email, or phone support must be provided to clarify the confusion of the customers and streamline their experience. Virtual assistants and chatbots can help customers provide 24* 7 support related to policies and premiums.

Notifications and Alters

The real-time notification system is essential to keep users updated regarding new policies, premiums, claims, and more. However, these apps must also provide updates related to natural disasters in their nearby locations as they impact their insurance policies.

Stepwise Process to Build a Winning Insurance App

To build a winning insurance mobile app you need to consider multiple factors and it also requires thorough planning. In this section you will get a stepwise process of developing an innovative insurance app for your business:

Define Your Goals and Audience

The development of insurance apps begins with planning and research. First, we need to analyze the target audience of the market, current trends, and competitors in the insurance sector. In this step, you can also accumulate the feature you want to integrate into the application to make it differentiated. Once you are done with the research stage you can create a wireframe of the app to visualize the design and functionality of the application efficiently. This is the most important step as here you create a complete blueprint of your application. Set an objective whether you want to focus on claim processing, policy management, or improving customer engagement.

Research and Planning

Once you have set the goal of your application, move forward with the next step which is research and planning. Here, you must research loopholes and the strength of the current insurance apps. Considering all these factors identify the areas that you can improve to provide better user satisfaction. Now, map out the whole process of development for more streamlined operations and navigation throughout the application.

Choose the Right Technology Stack

This is one of the most important steps as technology plays an important role in the smooth functioning of the application. Select whether you want to use iOS or Android platform for app development.

Frontend and the backend languages of the insurance apps must be chosen with care to provide smooth functioning of the application. Continue reading to learn about the key technologies to build an insurance app:

Back End Tech Stack

Server: Apache, Nginx, Microsoft IIS

Hosting: AWS, Google Cloud, Microsoft Azure

Storage: Amazon S3, Google Cloud Storage, Azure Storage

Database: MySQL, PostgreSQL, MongoDB, Cassandra

Payment Gateway: Stripe, PayPal, Braintree

Other: Git, Jenkins, Docker, Kubernetes

Front End Tech Stack

Android: Java, Kotlin, Android Studio, Android UI

iOS: Objective-C, Swift, XCode, UIKit

Cross-platform: React Native, Flutter

You can also read this about the top features and the tools required for iOS app development.

Design UI/UX

Once you have decided on the technologies you want to use for your app development, continue with the next step designing a user-friendly interface that showcases your brand value and the interface must also relate to your target audience. From registration to claim filing, all the functionalities used in the application must have a concern to improve user experience.

Develop and Test Your App

After the designing process of the application, move on to the development phase. In the development process, you should begin with integrating all the necessary features and functionalities like claims processing, user registration, secure payment integration, and policy management. Once the application is developed conduct it’s thorough testing to identify and resolve the bugs before the deployment process.

Deploy and Launch

After the testing stage, prepare your application for the deployment process. Read all the guidelines of the Google Play Store and the Apple App Store to ensure an informed deployment process. Now, you can start marketing your application through multiple channels like social media, content marketing, and strategic partnerships.

Monitor and Update

Analytics tools can be incorporated to monitor feature usage, user engagement, and application performance after launch. Prioritize updates according to user demands and market trends after gathering user feedback to identify areas for improvement.

By closely adhering to these guidelines, you can make sure that your insurance app provides genuine value, which will expedite business expansion and enhance customer satisfaction while also expediting the development process.

Read this to learn how to build an on-demand insurance app for a startup and an establsihed firm.

Factor Wise Cost of Developing an Insurance App

The cost of developing a mobile app depends on multiple factors including the complexity of the features, area of development, and the expertise of the developers. Below is the categorization of the cost based on the complexity of the application.

Cost of Simple Insurance Mobile App Development— If you are planning to build a mobile app with the help of basic functionalities, it may cost between $15,000 and $50,000. In an insurance app with basic functionalities, we incorporate features like basic policy management and user registration.

Cost of Complex Insurance Mobile App Development – Insurance apps with medium-level complexity, consisting of features like customized user interfaces, in-app chat, and payment gateways will cost between $50,000 to $100,000. These additional features are applied to enhance user satisfaction and functionality of the application.

Cost of Advanced Insurance Mobile App Development— Now, if you want to provide a unique feature to the users integrate some features like business intelligence tools, predictive analytics, and geolocation services. These additional services will also increase the development cost and will cost you around $100,000 to $350,000.

Final Words

Due to an increasing demand for the insurance mobile app, it is considered the best time to invest in these apps. However, if you still have doubts regarding app development you can connect with the expert development team at DianApps. Our team can help you streamline operations, understand the regulatory market, and improve customer engagement. These features ensure that your app meets industry standards and fulfills all the user requirements. Connect with our mobile app development company to change your insurance app concept into reality.

Leave a Comment

Your email address will not be published. Required fields are marked *