Remember when carrying cash was a necessity? Whether buying groceries, paying for a cab, or dining out, physical money was always in our wallets.

Fast forward to today: with the surge of online solutions, digital wallets have transformed how we handle transactions.

With just a few taps on our smartphones, we can pay bills, send money, and even shop globally, all without touching a single banknote.

The global digital payments market is booming, with transactions expected to exceed $14 trillion by 2027.

The convenience, security, and speed of digital wallets have made them essential for both individuals and businesses.

If you want to adapt to this cashless trend, setting up a digital wallet is the first step. After this, ensure that the best FinTech software development company is hired to build an innovative digital wallet application.

In this guide, we will walk you through the process step by step, ensuring that you can start making secure and seamless transactions in no time.

What is a Digital Wallet?

A digital wallet is a financial transaction application known as an electronic wallet. These digital applications allow users to manage, store, and use their payment information for transactions on mobile devices.

Moreover, this software is highly secure, enabling you to store your credit and debit card information, other payment methods, and bank account details without fear of scams.

With the innovation of digital wallets, users can now make payments, manage their financial transactions, and transfer money without requiring to carry money in cash.

Other than this, it also provides other features such as budgeting tools, personal finance software, coupons, and loyalty programs to enhance the user experience.

Market Stats Showing the Growth of Digital Wallets

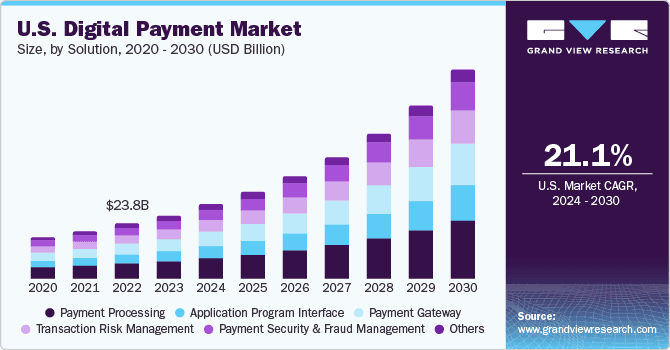

Digital Wallets were first introduced in the year 2004. According to the research report represented by Grand View Research, it has been estimated that the market size was valued at $23.8 billion in 2022.

It has also been estimated that the digital wallet market size will be enhanced at a compound growth rate of 21.1% from 2024 to 2030.

Research analyst says that with the growing smartphone users, the need for contactless payment options has also increased. Moreover, it has gained major popularity around the globe after the COVID-19 pandemic.

Looking at the above-given stats, you must be thinking, what should we expect from digital wallets in the upcoming 10 years?

Digital wallet use will continue to rise at a rapid growth rate. The adoption of AI technologies has also increased due to new technologies such as biometrics, AI, and blockchain. These innovations have made advanced technologies more appealing to consumers.

Innovative benefits of Digital Wallets for your Business

Today, most people are looking to adopt digital wallets. Many business owners are planning to invest in this prospective niche, but before developing one, you should know the answer to the question, “Why?”. In this section, we have presented some benefits of digital wallets that will help you understand the importance of creating a digital wallet:

Enhances customer engagement and loyalty

Digital wallets have eliminated the need to carry cash everywhere, now we can make payments and transactions from anywhere across the globe with just a click. This payment method can increase customer loyalty and engagement, as well as help businesses reach new customers who prefer digital payments.

Saves costs

With the advent of digital wallets, transaction costs have been reduced, as they reduce the need for traditional payment methods or physical cash. Moreover, digital wallets can streamline financial reporting and accounting processes, reducing administrative costs.

Provides data insights

These days, data plays a major role in everything from analyzing customer behavior to preferences. So, digital wallets are considered a favourable application used to collect data for businesses. This data can also be used to improve business marketing strategies and understand your customer base to provide more personalized solutions.

Provides higher security

Digital wallets are highly secured as they provide innovative features such as two-factor authentication and encryption, which can be used to protect users’ sensitive information from fraud and thieves.

Attracts and retains customers

It’s not compulsory that digital wallets need to have a separate application; it can also be integrated with other services such as e-commerce platforms or loyalty programs or reward systems. These platforms can increase the customer base of digital wallets.

Recommended Read: Multiple Wallets in One Card: The Solution to Carrying Multiple Cards

What Else Can Digital Wallets Do?

When it comes to digital wallets, it immediately clicks our mind as the mode of simplifying the transaction system. But let us clarify that this is also a great place to keep important documents organized and easily accessible.

Various documents can be stored in digital wallet apps without any worry of fraud and thieves:

Hotel reservations

- Gift cards

- Coupons

- Credit or debit cards

- Concert tickets

- Loyalty rewards cards

- Boarding Passes

Some brands even have their own digital wallets, this is majorly common in fast-food chains that also provide loyalty programs. For example, Starbucks motivates customers to use the app by providing them with stars in rewards that can be redeemed for free drinks. Gift cards from Starbucks can be uploaded and reloaded with a credit or debit card.

How Do Digital Wallets Make Money?

Now, you must have definitely come up with a question about how digital wallets make money. So, let us clarify that in the starting phase, digital wallets focus on features such as bill payments, e-wallet services, mobile top-ups, and e-commerce. Here is the complete breakdown of how to generate revenue:

Recharge Services

Most digital wallet app start their revenue generation model by providing recharge services. Recharge operators get 2-3% commission on every successful recharge through their platform. For instance, mobile networks charge extra when a customer recharges their mobile phones with the help of digital wallets.

Bill Payments

These wallet apps are also capable of earning some good amount of revenue through commissions on various bill payments such as utilities or tuitions. To provide all these seamless transaction facilities, these service providers compensate the digital wallet company.

E-commerce Transactions

Whenever you shop online, you must have come across several payment options, and among those options, you will definitely see wallet app options. Whenever a customer pays through these sources, the digital wallet makes revenue by taking a percentage of the final selling price of products. Commission of the product varies from 0% to 20% depending on the type of products and cost.

Recommended Read: Exploring the Landscape of Payment Technologies in M-Commerce

Here are some additional revenue generation models:

Seller Fees

Do you see movie or concert tickets available on a digital wallet application? Sellers of these tickets have to pay monthly fees to get their product listed on digital wallets.

Inter-Platform Transactions

You must have heard of some popular digital wallet applications such as Snapdeal and FreeCharge. These companies make money when customers make different transitions between their platforms. This model can be cleared with an example: like whenever a customer shifts from FreeCharge to Snapdeal, Snapdeal compensates FreeCharge for this transition.

Card Transaction Fees

Additionally, banks pay fees to websites that provide digital wallets when users use their credit or debit cards on these digital platforms.

Exclusive Seller Agreements

Some products are listed on wallet companies for sale. This is also one of the most important models that allow wallet companies to make a significant profit share of the number of sales.

How to Set Up a Secure Digital Wallet?

Various measures can be taken to minimize the risk of financial information from contacting fraudsters. In this section, you will get to learn about some advanced measures to enhance the security of your digital wallet application:

Two-factor authentication (2FA)

To ensure secure transaction facilities, digital wallet apps have to use additional authentication factors such as SMS codes or other identity verification. These factors are majorly used for enhancing an app’s security.

Passcodes and Biometric Authentication

Ensure to leverage the best highly secured password system for logging into the application. Other than this, you must regularly monitor your accounts for any suspicious activity. This is one of the most important measures that works against intruders.

Recommended Read: 4 Simple Steps to Add Fingerprint Authentication to Your Android App

Secure Data Transmission

Every digital wallet owner wants to provide a secure and swift transaction experience to users to increase the user retention rate. So, to ensure safe data transfer between the server and the application, you must implement SSL/TLS or VPN.

Point-to-Point Encryption (P2PE)

The process of encryption starts and remains with you throughout the entire transaction process. It starts the moment you initiate a payment by swiping your phone over a Point-of-Sale (PoS) terminal.

Major Challenges in Developing a Digital Wallet

Various challenges need to be addressed while developing a digital wallet application. Here, you will come across some challenges and ways to overcome them:

Compliance Regulations

The fintech industry has come a long way. As businesses across this industry have to follow strict regulations offered by central banks. Particularly, digital payment apps have to follow some strict compliance guidelines such as the Gramm-Leach-Bliley Act (GLBA), PACI (Payment Card Industry, the General Data Protection Regulation (GDPR), Anti-Money Laundering (AML), and Payment Services Directive 2 (PSD2) and Strong Customer Application (SCA) in Europe. It is difficult to find the right regulations for your application as it definitely varies based on country to country and even within states.

Fraud Detection and Risk Mitigation

Increasing digitalization has increased the chances of cyber security threats in digital wallet app development. There are still many users who are unfamiliar with the uses of digital apps due to the fear of scams and fraudulent activities. However, to these issues, developers can easily implement security best practices and advanced technologies.

Integration with Existing Systems

Apps for digital wallets frequently need to interface with banks and credit card networks, which are well-known payment methods. Working with several partners and doing thorough testing may be necessary to guarantee a smooth integration with these systems.

Final Words

While hiring a mobile app development company seems invaluable and expensive in the short-run but it ensures to provide you with some innovative tools for businesses and consumers. This blog has covered all the important information related to the process of how to set up a digital wallet and the significance of digital wallet development in this advanced technical world.

If you are thinking about how to create a mobile wallet app, ensure to connect with a leading firm that has expertise with fintech app development.

Leave a Comment

Your email address will not be published. Required fields are marked *