If anyone is keeping count, the Fintech app development industry has grown thrice a time more from 2022 till today and is expected to cross $645 billion by 2029 at a CAGR of 25.18%.

With the constant shift in the finance and banking business and the growth of AI-powered finance tools and technologies, developers have had the better opportunity to build Fintech products that have shown excellent results in terms of:

- Streaming cross-border payment flow

- Addressing security and fraud issues

- Personalized financial solutions

- Credit scoring and lending

- Blockchain and Decentralized finance (DeFi)

- User experience and accessibility

- Smart Contracts and automation

We may go on about how fintech technology experts in 2025 are eradicating a wide range of challenges with effective and solution-driven approaches.

But today, we will be focusing on hiring FinTech developers from the top FinTech development companies and discuss:

- Fintech developer salary

- What programming language does Fintech use

- What skills should fintech developers possess in 2025

- Tips to hire a freelancer or a full-time fintech developer

- Steps to find and hire the right fintech developers for your project (Kind of the most important part of this blog)

So, what’s the wait? Let’s begin by providing a precise fintech app development guide!

How is Fintech Growing?

Why is Fintech growing so fast? What is the future of Fintech? We hear that a lot!

When the COVID-19 pandemic hit us, a new wave of online and contactless payments accelerated, as customers sought safer, more secure ways to manage transactions. Digital wallets, peer-to-peer payment apps like PayPal, Apple Pay, Google Pay, and contactless card payments became mainstream, reshaping how consumers and businesses interact with money.

In fact, a survey conducted by McKinsey quoted, Financial technology is a sign of a new era of payments and is more focused on sustainable and profitable growth.

Another way Fintech is growing is through lending. In the past, if you wanted a loan, you had to go to a bank.

Now, fintech companies offer new ways to borrow money, like “Buy Now, Pay Later” services, where people can buy products and pay for them in installments.

This is very attractive to younger generations who prefer not to use credit cards and want more flexible payment options.

Let’s see some of the key developments that have made Fintech the talk of the town industry:

- Integration of Artificial Intelligence that has improved customer experiences, streamlined operations, and improved decision-making.

- Regulatory developments are intensifying oversight to ensure consumer protection and financial stability.

- Emergence of stablecoins and digital currencies to enhance payment systems and financial services.

- The adoption of open finance is gaining traction, extending beyond banking to include insurance, investments, and pensions.

- Witnessing increased investment and merger and acquisition (M&A) activities, driven by economic recovery and technological advancements.

- There’s a growing emphasis on sustainable finance within the fintech industry, with investments in green fintech solutions such as carbon tracking and green loans.

What’s the latest breakthrough for Fintech? Artificial intelligence is coming to the world of investment advice, and it can speak in Gen Z slang. Imagine how far finance technology has come and will go in the future.

So, to answer how Fintech is growing? It’s making financial services easier to use, more affordable, and more inclusive. It’s bringing technology and finance together, allowing people to handle money in ways that were not possible before, all from the comfort of their smartphones.

What are the Top Fintech Development Trends in 2025 for Developers?

In the continuation of what we mentioned earlier, AI is the glue that holds digital transformation, and Fintech is the major victim of this influencing trend. Some of the other top fintech development trends that help developers grow their tech capabilities are mentioned ahead in this section:

#1. AI & Machine Learning in Fintech

One of the top fintech development trends in 2025 is the integration of artificial intelligence (AI) and machine learning (ML).

These technologies are becoming pivotal in automating financial services, improving decision-making, and providing personalized customer experiences.

Developers will be building more sophisticated AI algorithms to enhance fraud detection, predictive analytics, and risk management.

AI-powered tools can process vast amounts of financial data in real time, enabling businesses to offer tailored services and products that meet specific customer needs.

For developers, mastering AI frameworks like TensorFlow and PyTorch will be crucial for creating intelligent financial platforms that can adapt to market trends and user behavior.

#2. Blockchain and Cryptocurrency Solutions

Blockchain technology is gaining significant traction in fintech, particularly with the rise of cryptocurrency and decentralized finance (DeFi) platforms.

In 2025, blockchain will continue to drive transparency and security in financial transactions. Developers will focus on building smart contracts, secure digital wallets, and cryptocurrency exchanges that offer seamless, decentralized experiences.

As the demand for non-fungible tokens (NFTs) and digital assets grows, there will be more opportunities to innovate on blockchain platforms.

To stay ahead of the curve, fintech developers should become proficient in Solidity for smart contract development and Ethereum for building decentralized applications (dApps).

#3. RegTech Solutions for Compliance

With growing regulations surrounding fintech, regulatory technology (RegTech) is becoming essential for financial institutions to ensure compliance and security.

Developers in 2025 will increasingly focus on creating tools that streamline compliance processes through automation, KYC (Know Your Customer) procedures, and AML (Anti-Money Laundering) checks.

These tools will help fintech companies stay compliant with global financial regulations while reducing human errors and operational costs.

Developers will be leveraging AI and big data to build RegTech solutions that can automatically detect fraudulent activities and generate real-time reports, simplifying compliance for fintech firms.

#4. Open Banking and API Integration

The adoption of open banking is revolutionizing the fintech landscape by allowing third-party developers to build new applications and services around financial institutions’ data.

API or Application Programming Interface, continues to give seamless data sharing between banks and fintech companies. These integrations will allow customers to access their financial information across multiple platforms, enhancing their ability to manage personal finances in one place.

Developers will need to focus on creating secure and scalable APIs, ensuring smooth data sharing while adhering to privacy and security standards.

Open banking will continue to drive innovation, enabling new payment solutions, lending platforms, and budgeting tools.

The ultimate banking app development, see how to get started!

#5. Personalized Financial Services

This trend is a combination of all trends, especially AI & ML. Fintech will increasingly focus on personalization.

With the help of AI, developers will create platforms that tailor financial advice and investment strategies based on individual preferences and goals.

Machine learning algorithms will help analyze consumer data to provide customized financial solutions, such as budget recommendations, investment portfolios, and even personalized lending rates.

By developing fintech platforms that prioritize personalized user experiences, developers can cater to the growing demand for more user-centric financial services.

Trends like sustainable finance and green fintech, embedded finance and digital wallets, etc, are some of the other Fintech trends that are driving the industry forward while providing businesses and developers with new, exciting problem-solving opportunities.

What are the Roles and Responsibilities of Fintech Developers That Businesses Should Know Before Hiring Them

When considering hiring FinTech developers, a business team must be aware of their roles and responsibilities before choosing the right engineers for their FinTech development ideas. So here are the most important ones listed below:

Role No.1 What do developers do in Fintech?

Software platforms used in the financial services industry are created and maintained by Fintech developers. Developing apps, platforms, systems, algorithms, and other solutions is frequently their area of expertise. Every project makes firms run more smoothly.

Role No.2 How do Fintech developers contribute to business development?

Fintech developers actively support fintech business development by identifying technical efficiencies, optimizing cost structures through automation, and enabling features that drive user engagement. Their technical input often shapes go-to-market strategies and product scalability decisions.

Role No.3 How do Fintech developers approach MVP development?

During Fintech MVP development, developers focus on launching a minimum viable product with just enough features to validate the business idea. They prioritize speed, clean code structure, and scalable architecture, allowing businesses to test market response before full-scale investment. Quick iterations and feature modularity are key here.

Role No. 4 What is the role of Fintech programmers in compliance and security?

Fintech programmers are at the frontlines of implementing data protection measures. They embed encryption, multi-factor authentication, and secure coding practices to comply with standards like PCI DSS, GDPR, and local financial regulations. Security isn’t optional in fintech—it’s a built-in feature.

Role No. 5 Which tools and technologies do Fintech developers use?

Depending on the fintech segment (banking, insurance, crypto, etc.), developers use languages like Python, Java, Go, or Solidity. They work with databases like PostgreSQL or MongoDB, cloud platforms such as AWS or Azure, and fintech-focused APIs (e.g., Plaid, Stripe). Staying current with this stack is part of the fintech developer roadmap.

Role No. 6 How do Fintech developers integrate third-party services?

A core responsibility is integrating APIs for payments, identity verification, KYC/AML checks, and more. Developers ensure seamless connectivity and performance when linking platforms like Razorpay, PayPal, or blockchain-based wallets—making financial transactions fast and trustworthy.

Role No. 7 How do developers track and optimize Fintech platforms post-launch?

After a product goes live, developers use analytics tools like Mixpanel, Google Analytics, or custom dashboards to monitor performance. They analyze conversion funnels, identify drop-off points, and implement fixes or feature upgrades based on real-time data.

Role No. 8 What is the Fintech developer roadmap in 2025?

A 2025-ready fintech developer roadmap includes mastering financial regulations, learning about blockchain integrations, gaining proficiency in cloud architecture, understanding payment ecosystems, and adopting tools for CI/CD and DevSecOps. Continuous learning is non-negotiable in this space.

Role No. 9 What’s their role in innovation and trend adoption?

Developers stay on top of fintech trends—like AI-powered fraud detection, open banking, and embedded finance—and bring innovative solutions to the table. Their insight into what’s technically possible fuels the next generation of financial products.

Here, we have tried incorporating all the roles of fintech developers with a unique touch that comes with questions which you might have while understanding a Fintech software development company’s responsibility. We hope this approach clears most of your doubts and makes you confident on moving on with the hiring process.

Also read: How to speed up fintech software development!

How to Hire Fintech Developers? Here are Some Easy Steps to Follow!

Step 1. Define Your Fintech Product Vision Clearly

Before hiring, outline what kind of fintech solution you’re building — whether it’s a lending app, payment gateway, crypto platform, or personal finance tool. This clarity helps you filter candidates with relevant domain experience.

Step 2. Decide Between MVP or Full Product Build

If you’re at the idea stage, you may need fintech MVP development expertise. For a mature product, look for developers experienced in scaling fintech platforms and ensuring compliance.

Step 3. Identify the Tech Stack and Skill Requirements

Know what you need: Python for backend, React for frontend, Solidity for blockchain, etc. Also, prioritize fintech-specific experience like API integration (Plaid, Stripe), KYC/AML processes, and secure coding.

Step 4. Look for Developers with Fintech-Specific Experience

Avoid generalists. Look for fintech developers who have already worked on financial apps, understand regulations, data security, and the fintech development lifecycle. Check portfolios for real-world fintech projects.

Step 5. Use Trusted Talent Sources

Post jobs on fintech-specific job boards or platforms like Toptal, Arc, AngelList, or Upwork (but vet them carefully). You can also hire via fintech development agencies that specialize in end-to-end product delivery.

Step 6. Conduct a Fintech-Focused Technical Interview

What gives any interviewer like you the confidence to hire a team? It’s by seeing whether the developer is able to crack all your doubts and understand your business objectives effectively. So, here are some questions that might be a value-adds while conducting a technical round with the company or developer.

- Can you walk us through how you’d architect a scalable fintech MVP from scratch?

- How would you implement secure payment gateway integration (e.g., Stripe or Razorpay) and ensure PCI-DSS compliance?

- What encryption or tokenization methods have you used to protect sensitive financial data in past projects?

- Tell us about a fintech product you’ve built or contributed to. What was your role and what problems did it solve?

- Which financial APIs have you integrated (KYC, payments, Open Banking)? How did you handle authentication and data privacy?

- What fintech trends do you see shaping product development in 2025?

- How do you stay updated on changes in financial regulation or compliance requirements?

Step 7. Evaluate Soft Skills and Collaboration

Since fintech often requires collaboration with compliance, marketing, and customer service teams, ensure the developer can communicate well, handle feedback, and align tech work with business goals.

Step 8. Discuss Engagement Model and Time Zones

Whether you’re building a fintech MVP, scaling an existing product, or adding new features, choosing the right engagement model for hiring developers is crucial. Here’s how to evaluate full-time vs freelance vs fintech dev agency, so you can confidently decide what suits your needs.

1. Full-Time Fintech Developers

Ideal for startups or fintech companies looking to build and maintain long-term products in-house.

Who needs them?

- Best for product stability, consistent updates, and scaling over time.

- Developers become deeply embedded in the business and product.

- Easier to manage code quality, documentation, and team culture.

Efficiency:

- Great for long-term roadmaps, fundraising-focused startups, or regulated fintech firms needing tight control over data and development.

- Expect a higher upfront cost (salaries + benefits), but long-term ROI.

Best for:

- Core product development

- Long-term fintech business development

- Internal IP protection

2. Freelance Fintech Developers

Perfect for founders or small teams who need quick, affordable help with MVPs, small integrations, or prototypes.

Why choose this model?

- Cost-effective for short-term or one-off tasks (e.g., API integration, UI fixes).

- Access to a global talent pool with specific niche skills (e.g., crypto wallets, KYC modules).

- Flexible engagement — hire when needed, no long-term commitment.

Efficiency:

- High agility for early-stage testing or technical validation.

- Needs careful vetting and management to ensure quality and timelines.

Best for:

- Fintech MVP development

- Time-sensitive tasks

- Budget-limited startups

3. Software Development Companies

Great for non-technical founders, funded startups, or businesses wanting to outsource entire fintech product development to experts.

Why choose this model?

- Comes with a full-stack team: developers, designers, QA, PMs, compliance consultants.

- Often specializes in fintech architecture, security, and regulations.

- Faster delivery with scalable teams and ready-made processes.

Efficiency:

- Predictable timelines and pricing with SLAs and contracts.

- Higher upfront cost than freelancers but lower long-term risk compared to hiring a team from scratch.

Best for:

- Building complete fintech platforms

- Scaling fast with predictable output

- Startups without in-house tech team

Regardless of the model, timezone overlap and availability matter for smooth collaboration. Here’s what to look for:

- Freelancers: Confirm hours and communication windows (especially for async work).

- Full-time hires: Prefer 70–100% overlap with your core hours.

- Agencies: Ensure they offer dedicated project managers or point-of-contact within your working hours.

Pro Tip:

If you’re unsure where to start, begin with freelancers or agencies for MVP/validation, and transition to full-time developers once the product gains traction or funding.

Step 9. Sign Contracts with NDAs and IP Clauses

Always protect your Fintech business IP and customer data. Use legally binding contracts, NDAs, and clearly state ownership of all code and assets.

Step 10. Provide Clear Roadmap & Feedback Loop

Share your fintech developer roadmap and create a feedback loop. Align product milestones, code quality standards, and communication expectations from day one.

Where to Find the Best Fintech Developers?

For your fintech app to be developed properly, you need the top fintech developers. Where can one locate them, I wonder? We provide a number of resources that might help you find the developers you require. But we are not going to bore you with lengthy paragraphs!

Here is the list of approaches that help you find the best developers in Fintech.

- Hiring an in-house team

- Searching Fintech developers on LinkedIn, Indeed, clutch, etc

- Asking your professional circle for trustworthy fintech developers

- Outsourcing to software development companies or freelance developers

What is the Average Rate of Fintech App Developers?

To determine the average cost of fintech app developers, the breakdown goes like this– region, engagement model, and experience level.

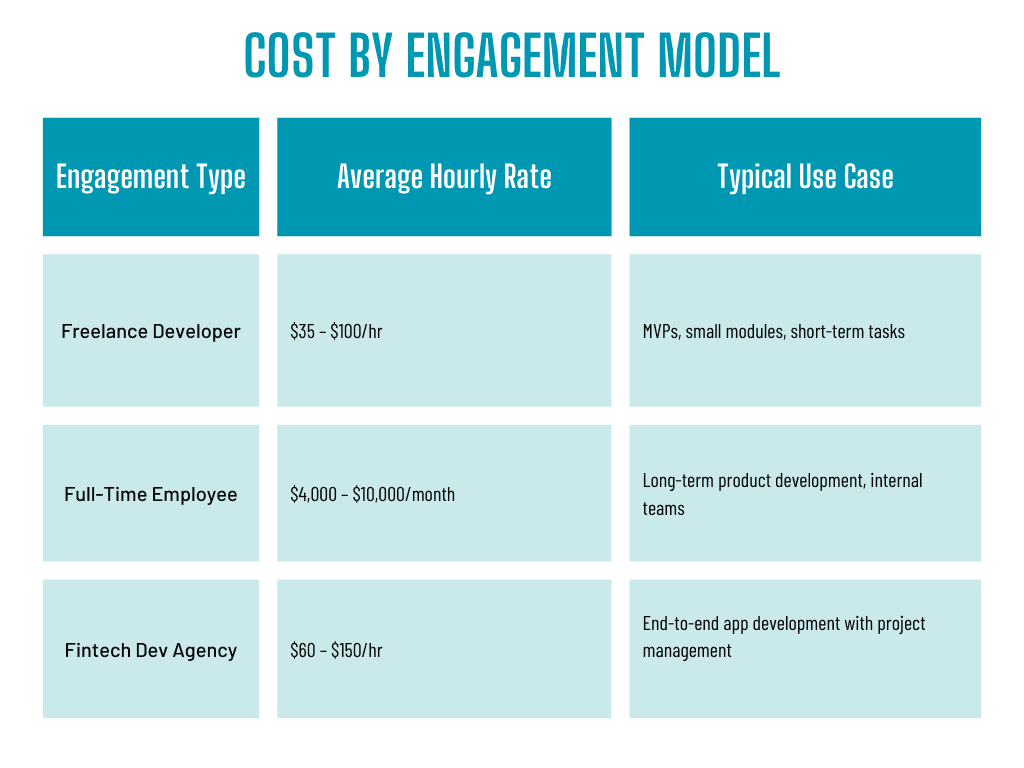

Cost By Engagement Model

Note: Agencies often quote project-based pricing ($25K–$100K+ for MVPs), depending on features, timeline, and complexity.

Note: Agencies often quote project-based pricing ($25K–$100K+ for MVPs), depending on features, timeline, and complexity.

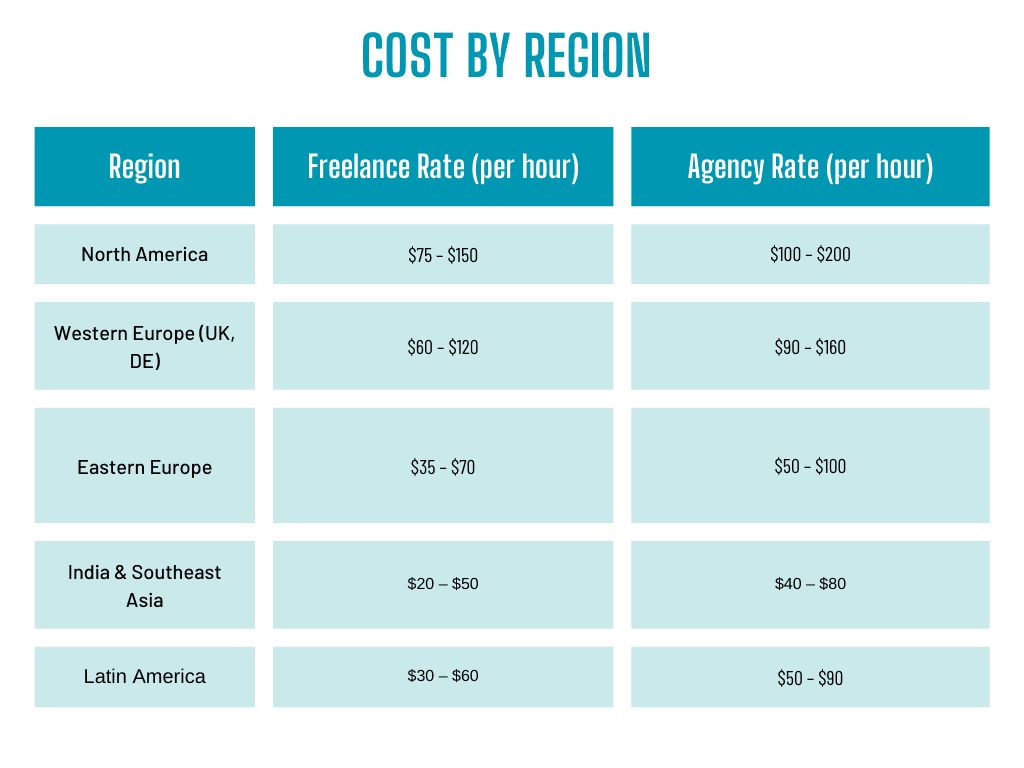

Cost By Region

India and Eastern Europe are popular regions for cost-effective Fintech MVP development with high-quality output.

India and Eastern Europe are popular regions for cost-effective Fintech MVP development with high-quality output.

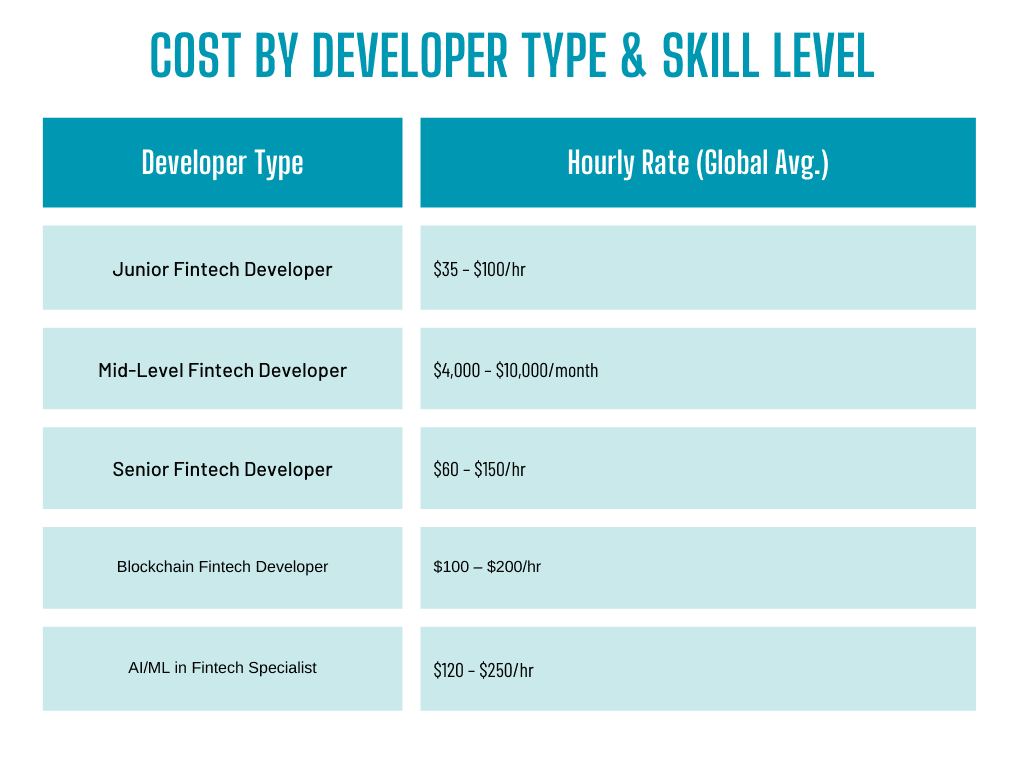

Cost By Developer Type & Skill Level

What is the highest paying job in fintech? According to the searches, Blockchain developers are among the most well paid jobs. While, the rates go up with fintech domain expertise: KYC, payments, lending, compliance, or blockchain integration.

What is the highest paying job in fintech? According to the searches, Blockchain developers are among the most well paid jobs. While, the rates go up with fintech domain expertise: KYC, payments, lending, compliance, or blockchain integration.

If you’re building a fintech MVP, a solid budget for a mid-level freelance or agency team would start around $15,000 – $40,000, depending on complexity. Hiring a dedicated senior developer full-time could range from $5,000 – $10,000/month.

What Makes DianApps an Ideal Fintech App Developers?

At DianApps, we pride ourselves on being the ideal partner for fintech app development because we seamlessly blend cutting-edge AI technology with the expertise of our skilled app developers.

Our team understands the complexities of the financial space and builds secure, scalable, and compliant fintech solutions that are tailored to our clients’ goals.

We leverage AI to power smart features like fraud detection, personalized insights, and predictive analytics—helping our clients stay ahead of the curve.

Whether it’s building a fintech MVP or a full-scale platform, we bring innovation, precision, and reliability to every project we take on.

Final Thoughts?

Developing creative and safe financial apps requires hiring the best FinTech developers. Building a solid development team that propels your company ahead may be achieved by adhering to a smart hiring procedure and keeping up with emerging trends.

With our knowledgeable and talented staff, DianApps is ready to help with your financial software development needs and guarantee that your projects are completed on schedule and within your allocated budget.

Leave a Comment

Your email address will not be published. Required fields are marked *