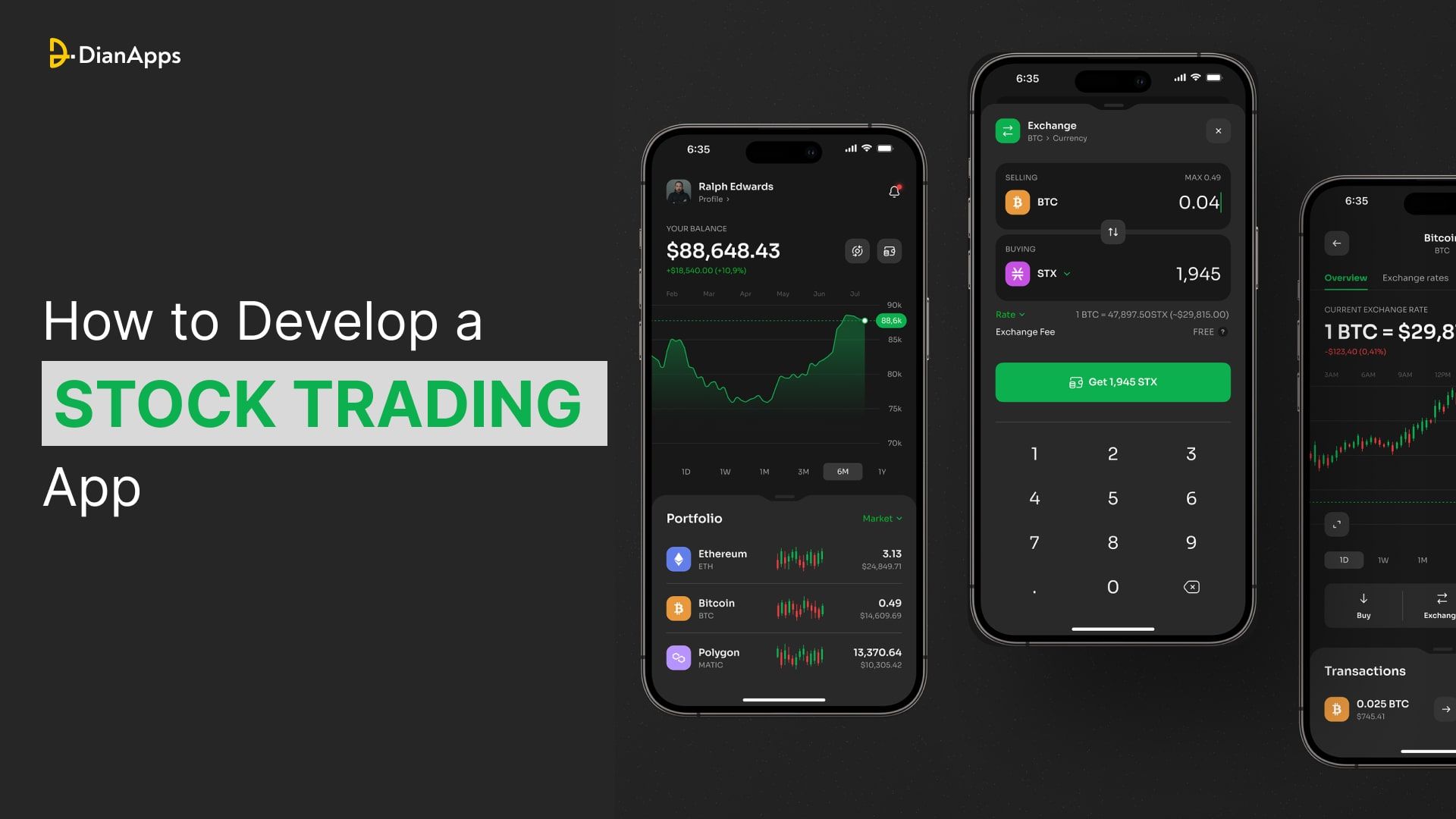

Why should you invest in a stock trading app? It is a risk-taking investment but imagine if your developed application becomes the new face of a multimillion-dollar global trading market.

While the thought seems extravagant, it needs a strong foundation AKA an application setup. How do you program a trading app? Will a stocking trading app for beginners generate more profit than a complex setup?

Well, there are many interesting aspects of building a trading platform! All you would need is a master plan and a well-established collaboration with a mobile app development company, and you are good to make something EPIC!

Although why is app development important?

Considering the changing landscape of the technology world, having an app becomes a convenient option to bring your product closer to your users, drive conversions, track market behaviors, and build trust more quickly as everything will be presented online!

Want to make your stock trading passion a real thing? This is your chance to have it!

The Present State of Stock Trading App Market

Before stepping on the journey to becoming the best trading app to make money and capture fame, we need to understand the stock market mobile apps industry. Here are the trending statistics for your reference:

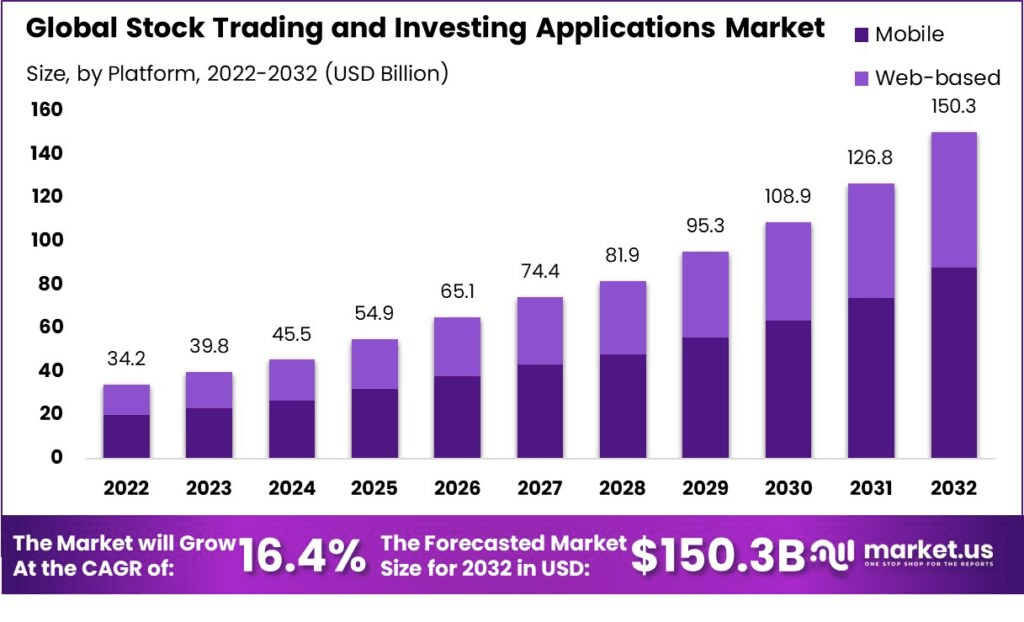

According to sources, the stock trading app market collected a total of 39.8 billion in 2023 and is expected to grow 150 billion by the time we reach 2032 which is a rise of 16.4% of CARG.

What is influencing the stock trading app market? Cloud-integrated stock trading applications are the main source of demand for these apps. Financial solutions hosted in the cloud have several benefits. Apps for stock trading also offer statistics, performance, and financial state analysis of the stock trading app market.

Because of their adaptability and variety as financial tools for risk management, hedging, and speculating, derivatives became the leading market category, accounting for roughly 32.3% of the revenue share.

Investors are increasingly using mobile trading and applications, which provide easy portfolio management on smartphones and tablets and enable well-informed decision-making.

What are the driving factors behind building a stock trading app?

Besides bringing massive traction in the Fintech app development business industry, building a stock trading platform can fill in the desire for real-time data and analysis collection on mobile devices, help in scaling user adoption of mobile technology, and allow increased accessibility to the stock market for retail investors.

How do stock trading apps work? Here are a few key pointers:

1. Democratization of Investing

One of the greatest challenges when having an offline stocking trading business is not having access to a broader range of investors. With an app for trading stock, you get the opportunity to not just access a broader range of investors but also offer a user-friendly platform on a user’s smartphone.

2. Real-time Data and Analysis:

Users can make better trading decisions when they have direct access to real-time market data, news, and analysis on a mobile device.

3. Advanced Features:

More experienced traders may be drawn to features like personalized portfolio analysis, charting tools, and algorithmic trading.

4. User Experience (UX) Design:

To draw in and keep users, an interface that is easy to use and navigate is essential.

Also read: How mobile app design companies create an effective brand identity

5. Market Competition:

The popularity of already-available stock trading applications, such as Robinhood, has shown how much need there is for easily navigable and accessible platforms.

6. Mobile First Strategy:

As the usage of smartphones increases, specialized trading software offers consumers a smooth way to manage their money while they’re on the road.

7. Technological Advancements:

New FinTech tech stack and APIs enable developers to create highly sophisticated trading apps with advanced features.

Best Apps For Stock Trading– Examples

There’s nothing wrong with knowing what’s best about your stock trading business competitors. We are here to learn and make better decisions in the business world and hence understand their USP to apply in your business app with of course your creative touch.

1. Robinhood

USP: Commission Free Platform

Robinhood pioneered commission-free trading, making it extremely popular among new and young investors. With a user-friendly interface and easy access to stocks, ETFs, options, and cryptocurrency, it provides a streamlined, no-fee trading experience.

2. TD Ameritrade (thinkorswim)

USP: Powerful Trading Tools and Education

Known for its sophisticated platform, thinkorswim by TD Ameritrade offers advanced trading tools, research resources, and in-depth educational content. It caters well to experienced traders looking for robust analysis tools and educational resources.

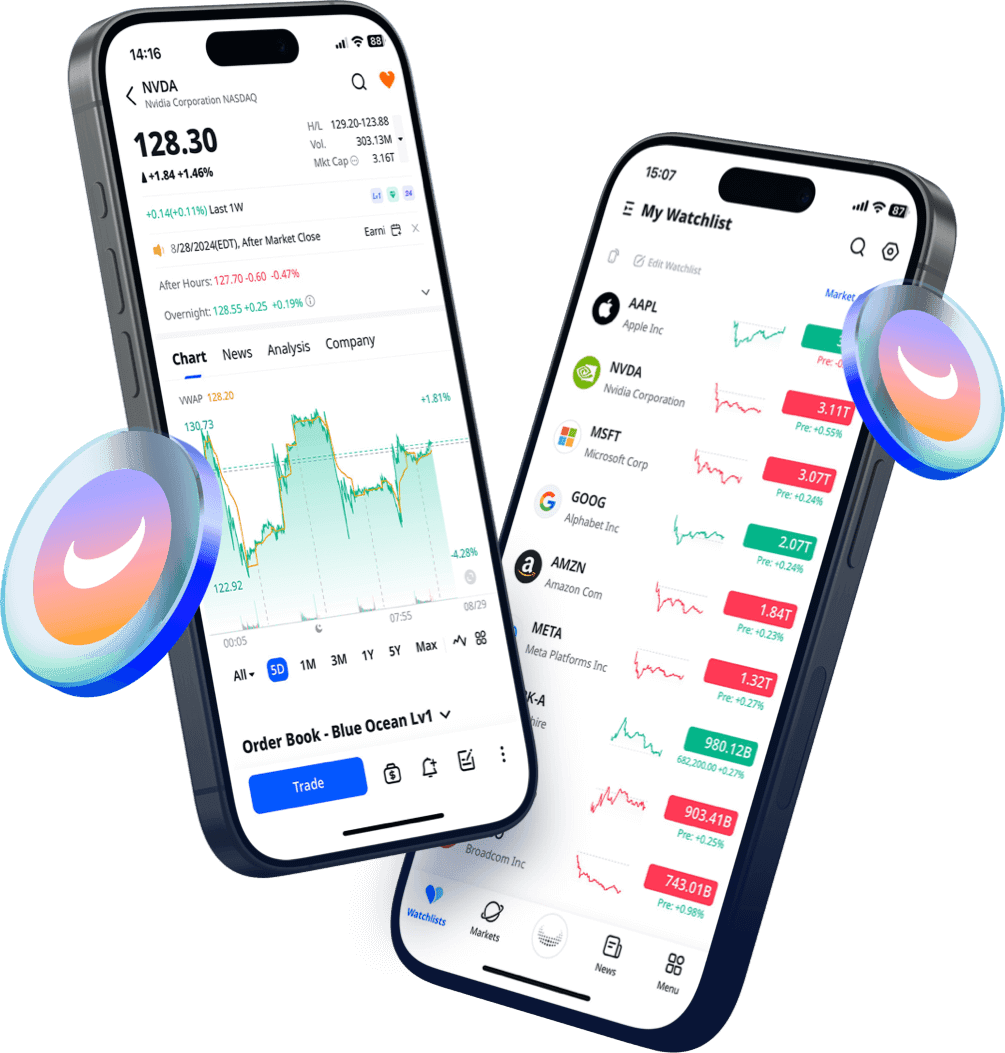

3. Webull

USP: Comprehensive Analytics and No Minimum Investment

Webull combines commission-free trading with powerful analysis tools, making it ideal for traders interested in technical analysis. With a host of customizable charts and indicators, Webull stands out for investors who seek in-depth insights without needing a minimum account balance.

4. E*TRADE

USP: Versatile Trading Platform with Multiple Tiers

ETRADE offers a highly versatile trading experience with its two platforms: ETRADE Web for beginners and Power E*TRADE for more experienced investors. It has intuitive design, extensive resources, and a wide array of investment options, from stocks to futures.

5. Fidelity Investments

USP: Comprehensive Research and Fractional Shares

Fidelity provides extensive research options, with a wealth of educational content, research reports, and market insights. Known for its reliability, Fidelity also allows fractional share investing, which enables investors to purchase smaller portions of high-value stocks.

These apps cater to a range of trading needs, from novice investors to seasoned traders, providing features like commission-free trades, powerful analysis tools, fractional share purchasing, and educational content.

What are the Steps To Build a Stock Trading Platform?

Building a stock trading app requires careful planning, solid technical foundations, and compliance with financial regulations. Here’s a step-by-step guide to developing a stock trading app:

1. Market Research and Requirement Gathering

- Objective: Identify the key features and determine the target audience for your app, whether it’s beginner investors, experienced traders, or institutional investors.

- Competitor Analysis: Analyze successful stock trading apps like Robinhood, E*TRADE, and TD Ameritrade to understand their features, strengths, and unique selling points.

- Feature Selection: Decide on the features, such as live trading, real-time market data, stock watchlists, charts, news feeds, and in-app support.

2. Define App Architecture and Choose the Tech Stack

- Front-end and Back-end Development: Select the technologies you’ll use for front-end (React Native, Flutter) and back-end (Node.js, Python, Ruby on Rails).

- Data Feeds and APIs: Partner with a reliable stock market data provider like Alpha Vantage, IEX Cloud, or Polygon.io for real-time data and financial information.

- Trading APIs: Integrate trading functionalities using APIs from brokers or automated FX platform, such as Alpaca Markets or Interactive Brokers, for placing orders and portfolio management.

3. Develop the User Interface (UI)

- User-Centric Design: Design the app’s layout, keeping it intuitive and easy to navigate. Ensure the interface is responsive and can handle data-heavy features like live trading charts.

- Features Integration: Add important UI elements like stock search, watchlist, buy/sell buttons, chart displays, and news feeds. Keep color schemes and buttons accessible and professional.

- Security Features: Integrate multi-factor authentication (MFA), encryption, and secure logins, as data security is crucial for financial apps.

4. Implement Core Functionalities

- Account Management: Enable user registration, profile creation, and KYC/AML verification (know your customer and anti-money laundering).

- Trading and Investment: Develop functionality for real-time trading, portfolio management, and monitoring. Include options for limit orders, stop-loss, and other trading types.

- Market Data Integration: Implement real-time stock updates, market indices, and charting tools using integrated APIs, with minimal lag for accurate trading.

5. Backend Development and Data Security

- Database Setup: Store user data, transaction history, and account balances securely in a database like PostgreSQL, MySQL, or MongoDB.

- Encryption and Compliance: Secure sensitive data using end-to-end encryption. Ensure compliance with regulatory requirements such as GDPR, FINRA, and SEC standards.

- Risk Management: Implement fraud detection algorithms, transaction monitoring, and risk analysis mechanisms to prevent unauthorized activities.

6. Testing and Quality Assurance

- Performance Testing: Conduct rigorous performance tests to check the app’s response under heavy data loads, as trading apps require quick processing times.

- Security Testing: Perform penetration tests and vulnerability assessments to ensure data security and compliance.

- Usability Testing: Conduct beta testing with real users to identify usability issues and improve user experience before launch.

7. Launch and Deployment

- App Store Compliance: Prepare the app for the App Store (iOS) and Google Play Store (Android) by following their guidelines and regulations. Ensure transparency in your terms of use, privacy policy, and disclaimers.

- Deploy Server Infrastructure: Set up secure cloud hosting for your servers, using providers like AWS, Google Cloud, or Azure, with scalability in mind.

- Market the App: Launch your marketing campaign, focusing on target users through social media, influencer partnerships, and financial communities.

Get a hands-on experience for your app’s online visibility through our Social Media Marketing Services as DianApps gives one-stop digital solutions to clients.

8. Post-Launch Monitoring and Updates

- Continuous Monitoring: Monitor user activity, feedback, and server performance for potential issues. Act on any feedback to improve functionality and stability.

- Add New Features and Enhancements: Introduce new features like cryptocurrency trading, robo-advisors, or AI-based stock recommendations to keep users engaged.

- Compliance Updates: Continuously update the app to meet any new regulatory or security requirements, ensuring users’ data remains safe and the app stays compliant.

By following these steps, you can build a robust stock trading app that provides a seamless, secure, and compliant trading experience.

Conclusion

Developing a stock trading app is a multifaceted process that demands a thorough understanding of both financial markets and advanced app development practices.

By following structured steps—from initial research and design to implementation, compliance, and post-launch monitoring—developers can create a trading platform that is not only functional but also secure and user-friendly.

Key components, like robust backend infrastructure, intuitive UI, real-time data integration, and rigorous security measures, are essential to deliver a smooth trading experience for users.

As the demand for digital investment platforms continues to grow, a well-built stock trading app can attract a wide range of users, from beginner investors to seasoned traders.

Focusing on continuous improvements, regulatory compliance, and user-centric enhancements will ensure the app’s long-term success in this competitive market.

By balancing functionality with security and ease of use, developers can create a trusted app that empowers users to make informed financial decisions.

Hire DianApps to build a stock trading app today!

Also read: Investment app development– Benefits, Features, and Development Process!

Leave a Comment

Your email address will not be published. Required fields are marked *