How Fintech is Changing the Future of Traditional Banking

For years, fintech app solutions have been filling gaps in the traditional banking sector and addressing the need for more flexible payment systems. On the one hand, fintech is becoming more connected to traditional financial services, the majority of banking services and insurance organizations expect to partner with fintech companies, for instance. On the other hand, banks are actively investing in technological innovations, creating greater competition in fintech.

Both factors are driving rapid growth in the global fintech market, which is estimated to reach more than $300 billion by 2023.

If you’re considering starting your own finance-based business, knowing the benefits and drawbacks of fintech custom software app development should be a key priority. Following that, a thorough analysis of the future scope of fintech and how it is changing the future of traditional banking is important.

In this post, we’ll overview the major future changes in the traditional banking sector caused by the emergence of fintech by discussing the drawbacks, benefits, and, practices of financial technology.

Let’s begin with understanding the pain points of traditional banking.

Challenges Faced by Traditional Banks

Slow digital transformation

Digital banking change has been extremely delayed in coming from traditional financial institutions. Their internet presence has mostly been restricted to providing the most fundamental fintech app development services like bill payments, transfers, deposits, and credit applications. As a result, banks are unable to fully benefit from next-generation IT technologies.

Impediments of legacy infrastructure

Many banks throughout the world continue to employ legacy infrastructure, which consists of core banking solutions (CBS) and outdated data sets. Regtech in banking modernizes regulatory compliance, reducing risks and costs associated with outdated systems. This infrastructure used to be able to offer some stability and security, but as more adaptable and modular alternatives have started to emerge, there is less and less room for these dated systems. For instance, the monolithic CBS is so well ingrained within the financial system that altering even one component might have a negative impact on the others.

The emergence of disruptive banking models

Every function from the old value chain is now being replaced by disruptive financial models, whether it be payments, investments, mortgages, or personal loans. Customers no longer need to wait in long lines, fill out onerous paperwork, or navigate complicated systems. Instead, customers may easily register with a well-known Fintech company and instantly get cutting-edge services that enhance the client experience!

Costs of maintaining a brick-and-mortar branch

A physical and mortar branch has more expenses than a digital bank because of its intrinsic expenditures. These consist of:

- Land or leasing costs

- Pay for employees

- Training of employees Management of capacity

- Consumer assistance

- Overhead expenses

And this is only the very beginning! Brick-and-mortar locations would also have to cover the expenses of technological adoption if they wanted to experiment with an innovation strategy. To consistently provide a better customer experience, they would also be compelled to track staff-customer interactions. As businesses seek more cost-effective financial solutions amidst rapid digitization, one favorable choice is exploring no annual fee cards for your business, which can significantly reduce overhead expenses while maintaining or enhancing service quality. Establishing a fintech ecosystem that supports these modern, efficient financial instruments is essential for future-proofing operations and ensuring accessibility to pivotal banking services without the burdensome costs

Improper customer engagement

People’s lack of trust in the current financial system was one of the main effects of the 2008 crisis. As a result, banks started to diversify their range of offerings to win back the public’s trust.

However, in a time when finding information, comparing goods, and venting complaints have never been easier, banks must stay clear of any potential pitfalls. They must respond quickly to consumer concerns while directing them toward a smooth and trouble-free banking procedure.

To overcome these traditional banking challenges, the concept of financial technology came into existence. Let’s see what this trending and most used technology has for organizations and individuals across the globe.

Introducing Fintech: Definition, Benefits, Drawbacks, & More!

What is Financial Technology?

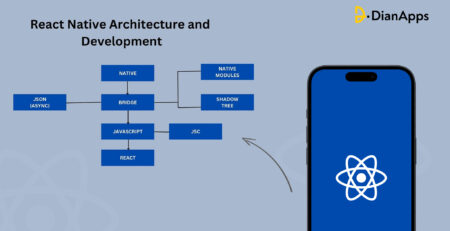

Fintech, as it is more often known, is a term used to describe emerging technology that aims to enhance and automate the provision of financial services. At its foundation, fintech app development services use specialized software and algorithms that are employed on computers and, increasingly, smartphones to assist businesses, company owners, and individuals in better managing their financial operations, procedures, and lifestyles. The term “financial technology” is combined with the phrase “fintech.”

The word “fintech” was first used to describe the technology used in the back-end systems of established financial institutions when it first appeared in the 21st century. However, since that time, there has been a change toward more consumer-focused services and, thus, a more consumer-focused definition. The term “fintech” currently refers to a variety of fields and businesses, including education, retail banking, nonprofit fundraising, and investment management, to mention a few.

Benefits of Fintech:

In the end, fintech aims to simplify and improve your financial life. And it can do more for you than just that. Fintech has several advantages for both customers and companies, including the following.

- Convenience and ease of use:

Thanks to chatbot technology, and fintech, you can now pay your bills, set up direct deposit, start a bank transfer, and more without having to spend hours on hold.

- Accessibility:

Fintech offers previously unavailable possibilities for financial transactions and services to persons who reside in remote locations or have impairments. Also, by using reliable payment solutions such as cascading and routing payments, users can avoid declines. Such a system acts like a GPS navigator, analyzing options and picking the best pathways to route payments to their destination and cascading declines for similar payment methods to reduce lost revenues.

- Security:

To shield individuals against fraud, fintech offers additional security measures.

-

- Savings:

By tying users’ credit card accounts and bank accounts together, fintech mobile app development services enable customers to save money.

Drawbacks of Fintech

1. Physical branching is absent

Since everything must be handled via email or social media, this might be a drawback if there is an issue with the service’s delivery.

- Although some fintech app development company leverage the usage of blockchain technology to increase security as a differentiator in this area, not all of them do, which puts the security of customer data in danger.

- Many people find it to be as simple as using their smartphones, the reality is that this condition immediately excludes a sizable portion of the population who do not have access to the Internet and will therefore encounter challenges in opening a bank account, even in the presence of Fintech.

2. Lack of supervision

It is a fact that this occurrence is so well-known that governments continue to research and legislate in many countries throughout the world. Because of this, the laws surrounding fintech across the world are not flawless, and there is a chance that some of these might constitute possible fraud in the absence of laws.

Fintech Practices to Adopt

Fintechs can remain on top of regulatory changes and offer strong security by using certain procedures and tools:

1. A method based on risk

To prevent financial crimes and data breaches, fintech should regularly undertake risk assessments. With the aid of capable fintech risk and compliance management systems, it makes sense to regularly analyze the regulatory landscape and make necessary adjustments.

2. Regulatory technology use (regtech)

A brand-new category of software known as regtech has emerged as a result of strict rules. Numerous solutions are planned to assist financial firms in adhering to rules and legislation. An illustration. AML software examines client data to look for suspicious activity and verifies that customers and transactions don’t match any sanctions. Automating the production of complaint reports concerning dubious transactions alleviates business pain points.

3. Adoption of AI:

For the detection of suspicious behavior, negative media screening, or other preventative actions, using AI-based technology can lead to increased precision and fewer mistakes. For instance, AI approaches may train systems to distinguish between genuine and fraudulent transactions, whereas AML systems frequently generate a large number of false warnings.

How is Big Business Responding to Fintech

The issue of whether fintech will alter financial services has been replaced, according to the most recent PwC Global Fintech Report, by the question of which companies will do so most successfully and become leaders:

Technology, media, and telecommunications (TMT) firms and financial services (FS) organizations used to share the same highways sometimes but not often in each other’s lanes. However, the distinctions between FS and TMT companies have already become so hazy that previously separate industries are slamming into one another. Many TMT businesses are requesting FS licenses, and FS organizations have started referring to themselves as technology firms. The center of this change is fintech.

Adopting fintech appears to be the greatest strategy for conventional banking’s survival. PwC estimates that as of 2019, 48% of financial services organizations have completely incorporated new technology into their strategic operating model and 37% have done so concerning the goods and services they sell.

Additionally, it will be crucial for businesses to employ fintech to enhance the simplicity and speed of their services as well as to enable the widespread personalization and customization that customers have grown to anticipate.

The Future of Fintech

By the beginning of 2020, fintech was already prospering, but the coronavirus pandemic hastened the process. Just a few weeks following the shutdown, banks discovered that while working from home and other limitations took effect, digital use had increased by 50% or more. There is no turning around. Most customers prefer to conduct business with businesses that accept contactless payments since they are reluctant to visit a real bank or ATM.

Leading financial analysts believe that the epidemic has sparked a desire for fintech in personal banking that would not have materialized for years.

The industry will continue to solve the problems that traditional banking causes so many customers. What therefore does the application of fintech to traditional banking hold for the future? Here are some crucial sectors that are currently seeing fast change:

- A massive increase in demand for mobile application development

- Products and services primarily intended for use with mobile devices

- Simple methods for transferring money between accounts

- Solutions for consumers with bad credit to qualify for loans

- Peer-to-peer lending growth

- Payments using contactless credit cards

- Education for financial success

The distinction between traditional banking and fintech will become increasingly hazy. Rapid digitization can help businesses better serve customer demands. When customers want a radical transformation from their financial institution, banks without a solid digital strategy are playing catch-up.

How we helped Khatabook in building their fintech app.

We worked on one of India’s first digital B2B ledger platforms, helping them make an app and website which records and maintains a digital record, tracks business transactions, collects online payments, and sends reminders to creditors.

We created a strong Fintech solution for Khatabook by fusing finance and technology, and it is effectively redefining the financial demands of merchants and customers. By simplifying the purchasing process for consumers and cutting down on merchant accounting time, we effectively deployed the solution, resulting in results for the client in the form of … merchant onboarding and .. transactions per day.

With several awards under our belt, we take satisfaction in being one of the fastest-growing software development firms. No matter what your Fintech business model is, DianApps being an on-demand app development solution provider and co-developer of a successful fintech app development solution can help you build outstanding mobile or web app development

Hire fintech app developers from us to scale your business vigorously now!