Scratching your head while making payments internationally? Wondering whether or not it is safe to pay to a vendor that sits far away from your country? We get it big time!

Having a seamless payment transaction is very important and therefore a far more reliable payment app was introduced in the 90’s– The PayPal payment app.

PayPal is a USA-based payment platform that has been setting the foundation of digital commerce for approximately 428 million customers worldwide for the past 25 years. It is a two-sided network that connects people and businesses in more than 200 markets cross-borders.

Through the app, users can unlock peer-to-peer payments, make international purchases or pay bills, and much more. How convenient, isn’t it?

If you have a similar app like PayPal development idea that fulfills the demand of a client or individual while giving a seamless money transaction journey then this blog is for you!

However, one of the pain points before starting any business is to know its cost estimations. Why so? Well, the cost of app development determines whether it is under your constructed budget or not. Having said that, the cost of building an international payment app like PayPal involves a lot of phases of app development such as:

- Reach and analysis

- UI/UX design services

- App development

- Testing

- Maintenance

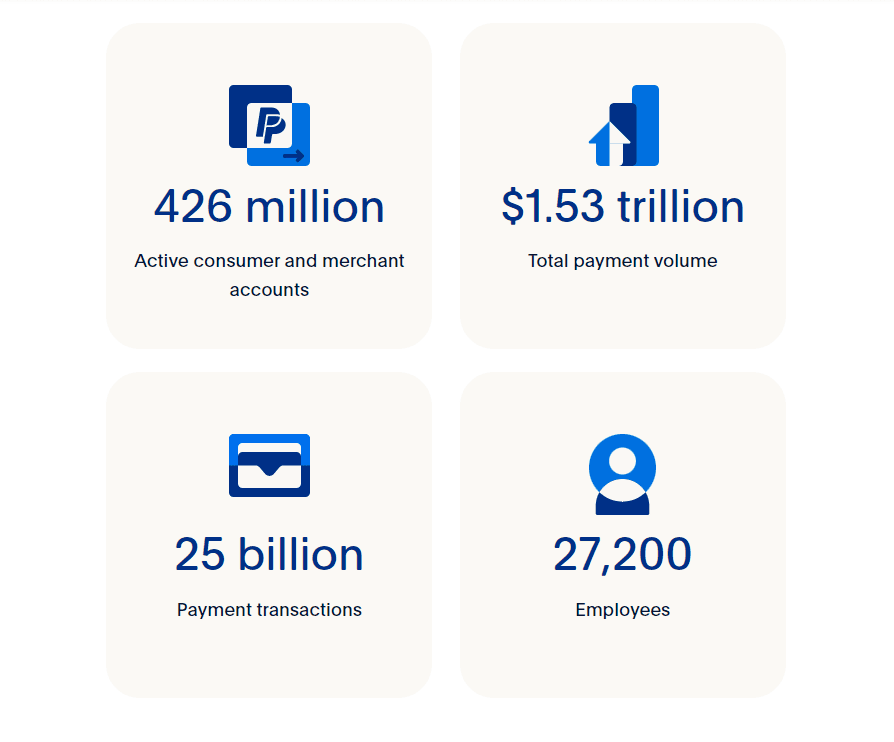

Let’s explore some important market demographics of PayPal, knowing how much this international payment app is worth.

PayPal Payment App– History & Facts

- As of April 2024, PayPal calculates a total of 428 million active consumer and merchant accounts.

- PayPal has a $1.53 trillion total payment volume in 2023.

- The online payment app PayPal records approximately 25 billion payment transactions.

- The company employs a team of 27,200 worth of employees currently.

- More than 40 strategic alliances have been formed by PayPal, including alliances with major issuers and card networks such as American Express, Discover, and Mastercard; banks such as Bank of America, Banorte, Barclays, Citi, HSBC, JPMorgan Chase, ShinhanCard, and Wells Fargo; and other financial institution partners such as FIS, Paymentus, and Synchrony.

- With a 42% global market share, PayPal dominates the payments service sector.

In the third quarter of 2023, there were almost 6.2 billion PayPal transactions, up from 5.6 billion the year before.

- As per Statista, PayPal is installed on 8,084 e-commerce sites in the USA.

Why is Understanding The Cost of Building An App Like PayPal Important?

Better Budgeting:

Having a clear understanding of the prices upfront helps with budget planning. It makes resource allocation effective for entrepreneurs, startups, or businesses, preventing unforeseen financial obstacles during the development phase.

Know how to reduce the mobile app development cost to improve your budget effectively.

Resource Allocation:

It takes a variety of resources, including human, financial, and technological resources, to develop a payment app. Knowing the expenses facilitates the efficient use of these resources, ensuring that the project moves on without experiencing a lack of resources.

Risk management:

Being aware of the expenses aids in spotting any hazards related to the project. Businesses may more correctly evaluate risks and apply risk mitigation techniques when they are aware of the financial ramifications of every development component.

Realistic Expectations:

Stakeholders, including investors, management teams, and developers, should have realistic expectations based on a clear grasp of the associated expenses. It aids in avoiding making exaggerated or inadequate promises on the project’s goals.

Competitive Advantage:

A deep grasp of expenses provides businesses with an advantage in the fiercely competitive fintech market. It enables companies to streamline their development procedures, possibly enabling them to provide their services with improved features or at more affordable prices.

Profitability Analysis:

It is made easier to do when the expenses are understood. Businesses are able to assess if the possible returns on investment outweigh the costs and make well-informed choices on pricing policies and income streams.

Compliance and Legal Considerations:

Developing a payment app entails paying attention to a number of legal and regulatory regulations, which may be expensive. Knowing these expenses makes it easier to make sure the software complies with all applicable laws without sacrificing its security or quality.

How Mobile Payment Apps Like PayPal Work?

PayPal is a peer-to-peer (P2P) provider independent of banks. The program makes use of its built-in Fintech software processing and money storage features without tying in with any financial institutions. With the use of its wallet feature, you may hold cash before transferring it to a friend or bank account.

Check out How PayPal Operates:

1) PayPal customers may easily and free of cost create their own PayPal accounts.

2) Users must connect their debit, credit, or prepaid cards to their PayPal accounts.

3) After that, users will have the choice to use PayPal to pay for purchases or send money to friends without having to input their credit card information on any other website.

PayPal functions as a merchant account in addition to a payment gateway. The program is among the greatest mobile payment apps available since it also offers amazing security features like address verification, encryption, and fraud prevention.

Features You Need While Building A Payment App Like PayPal

Building an international banking app like PayPal requires a robust set of features to facilitate seamless transactions and enhance user experience. Here are the core and additional features typically included:

Core Features:

1. User Registration and Account Creation:

Allow users to register for an account securely and easily, providing necessary information such as email, phone number, and password. Verification methods like email confirmation or phone number verification enhance security.

2. Payment Processing:

Enable users to send and receive payments conveniently using various payment methods, including credit/debit cards, bank transfers, and digital wallets. Integration with payment gateways and processors ensures secure and reliable transaction processing.

3. Fund Transfers:

Facilitate fund transfers between users within the app, whether it’s peer-to-peer transfers, payments to merchants, or splitting bills among friends. Provide options for instant transfers or scheduled payments for flexibility.

4. Multi-Currency Support:

Support multiple currencies to cater to users worldwide, allowing them to send and receive payments in their preferred currency. Real-time currency conversion rates ensure transparency and accuracy in transactions.

5. Transaction History:

Maintain a comprehensive transaction history for users, displaying details of past transactions, including date, time, amount, sender/receiver information, and transaction status. Search and filter options help users easily track their transaction history.

Additional Features:

6. Mobile Wallet Integration:

Seamlessly integrates with popular mobile wallets such as Apple Pay, Google Pay, and Samsung Pay to enable quick and secure payments using mobile devices.

7. In-App Messaging and Notifications:

Provide in-app messaging and push notifications to keep users informed about transaction updates, account activities, promotions, and security alerts.

8. Bill Splitting:

Allow users to split bills with friends or family members directly within the app, simplifying group payments and reducing the hassle of manual calculations.

9. Peer-to-Peer Payments:

Enable users to send money to other app users instantly, whether it’s for personal payments, shared expenses, or small business transactions.

10: Subscription Management:

Offer subscription management features for users to set up recurring payments for subscriptions, memberships, or services, with options to modify or cancel subscriptions as needed.

A few of the other features that can also be useful such as customer support chatbots, Cyrpt-payment options, buy now pay later, instant loading lending feature, multi-currency payments, etc. Make sure you ask all about these features of your mobile app development company during the conversation.

How Much Does It Cost To Make An App Like PayPal?

The cost of app development is also impacted by the varied business models used by e-wallet applications and online payment gateway development. The competency in the market now depends on low development costs.

Thus, you should arrange everything carefully in a way that will contribute more to the overall objectives of the company. The latest technological advancements are integrated to enhance the user experience. It highlights further justifications for the anticipated future gains for your company.

The quantity and complexity of the large elements in this series dictate how long it takes to build and how much it costs. It may be developed successfully by employing independent contractors or an internal team. Once more, the most important factor in determining the acceptance of an application is the development cost of the payment gateway.

Research and Planning Costs

Before embarking on the development journey of an international payment app like PayPal, thorough research and meticulous planning are essential. This phase incurs several costs, including:

- Market Research Expenses: Conducting comprehensive market research is vital to understand the competitive landscape, user demographics, and emerging trends. Market research expenses may include the cost of purchasing industry reports ($1,000 – $10,000), conducting surveys ($2,000 – $20,000), and analyzing market data.

- Feasibility Studies: Assessing the feasibility of the project involves evaluating technical, financial, and operational aspects. Feasibility studies may require hiring specialized consultants or experts ($5,000 – $50,000) to analyze various factors such as technology stack feasibility, scalability, and potential challenges.

- Cost of Hiring Consultants or Experts: Seeking advice from industry experts or consultants can provide valuable insights and guidance throughout the planning phase. The cost of hiring consultants or experts varies based on their expertise and the duration of their engagement ($100 – $500 per hour).

Investing in thorough research and planning upfront can significantly impact the success of the project by minimizing risks, identifying opportunities, and ensuring alignment with business objectives.

App Development Costs

Once the research and planning phase is complete, the development of an international payment app begins. This stage involves various costs, including:

- Software Development Costs: The largest portion of the budget typically goes towards software development. Costs can vary depending on the complexity of the app, the technology stack chosen, and the development team’s rates. On average, building a payment app like PayPal can cost anywhere from $100,000 to $500,000 or more.

Keep reading: How to choose the best Financial software development partner.

- Design and User Interface (UI/UX) Expenses: Creating an intuitive and visually appealing user interface is crucial for user adoption and retention. Design and UI/UX expenses include hiring designers, prototyping tools, and usability testing. Costs for design and UI/UX can range from $10,000 to $50,000 or more.

- Backend Infrastructure Costs: Developing a robust backend infrastructure capable of handling transactions securely and efficiently is essential for a payment app. Costs for backend development depend on factors such as server setup, database management, and integration with payment gateways. Backend infrastructure costs may range from $20,000 to $100,000 or more.

- Cost of APIs and Third-Party Integrations: Integrating with third-party services and APIs for features like payment processing, identity verification, and security adds to the development costs. Costs for APIs and integrations vary based on usage and subscription models, typically ranging from $5,000 to $50,000 or more.

Development costs constitute a significant portion of the overall budget and require careful planning and allocation of resources to ensure the successful delivery of the app.

Compliance and Legal Costs

Ensuring compliance with regulations and legal requirements is paramount when developing an international payment app. This involves various costs, including:

- Regulatory Compliance Expenses: Payment apps must comply with a myriad of regulations, such as GDPR, PCI DSS, and financial regulations specific to each country or region of operation. Compliance expenses include hiring compliance officers, conducting audits, and implementing necessary measures to meet regulatory standards. Costs for regulatory compliance can range from $50,000 to $200,000 or more, depending on the complexity of the regulatory landscape.

- Legal Consultation Fees: Seeking legal advice from experts in fintech law is essential to navigate the legal complexities associated with payment processing, data protection, and contractual agreements. Legal consultation fees vary based on the expertise and hourly rates of legal professionals and can range from $200 to $500 per hour or more.

- Licensing and Certifications: Obtaining licenses and certifications from regulatory authorities and industry bodies is necessary to operate legally and gain trust from users. Costs for licensing and certifications vary depending on the jurisdiction and the type of licenses required but can amount to thousands or even tens of thousands of dollars.

Security Costs

Security is paramount in the development of a payment app to protect sensitive financial data and prevent fraudulent activities. This incurs various costs, including:

- Implementation of Robust Security Measures: Investing in robust security measures such as encryption, tokenization, and multi-factor authentication is essential to safeguard user data and transactions. Security implementation costs can range from $50,000 to $200,000 or more, depending on the complexity and scale of the app.

- Encryption Technologies: Utilizing encryption technologies to secure data transmission and storage adds to the security costs. Costs for encryption technologies may include licensing fees and implementation expenses, typically ranging from $10,000 to $50,000 or more.

- Fraud Prevention Tools and Services: Implementing fraud detection and prevention mechanisms, such as machine learning algorithms and real-time transaction monitoring, helps mitigate the risk of fraudulent activities. Costs for fraud prevention tools and services vary based on usage and subscription models, typically ranging from $20,000 to $100,000 or more.

Investing in robust security measures is crucial to build trust among users and protect the integrity of the payment app.

Testing and Quality Assurance Costs

Thorough testing and quality assurance (QA) are essential to ensure the reliability, performance, and security of the payment app. This involves various costs, including:

- Testing Tools and Software: Investing in testing tools and software for functional testing, regression testing, and security testing helps identify and resolve issues throughout the development lifecycle. Costs for testing tools and software can range from $10,000 to $50,000 or more, depending on the scope and complexity of testing requirements.

- Hiring QA Professionals: Hiring skilled QA professionals to execute test cases, report bugs, and ensure compliance with quality standards is crucial for the success of the app. QA professionals’ salaries vary depending on experience and location, typically ranging from $50,000 to $100,000 or more per year per resource.

- Bug Fixing and Iteration Costs: Addressing and resolving bugs identified during testing and iteration cycles incurs additional costs in development. Bug fixing and iteration costs depend on the number and complexity of issues encountered but can range from $20,000 to $100,000 or more.

Investing in comprehensive testing and QA processes helps deliver a reliable and high-quality payment app that meets user expectations and regulatory requirements.

Marketing and Launch Costs

Successfully launching and promoting your payment app requires a well-planned marketing strategy and adequate resources. Here are the key cost components:

- Marketing Strategy Development: Crafting an effective marketing strategy involves market positioning, target audience identification, messaging, and channel selection. Costs for marketing strategy development can vary based on the complexity and scope of the strategy, ranging from $10,000 to $50,000 or more.

- Advertising Expenses: Promoting your payment app through various advertising channels, including digital advertising, social media marketing, influencer partnerships, and traditional media, incurs expenses. Advertising expenses depend on the chosen channels, ad placements, and campaign duration, typically ranging from $50,000 to $200,000 or more.

- Launch Event Costs: Hosting a launch event to generate buzz and attract attention to your payment app may involve venue rental, catering, event staff, promotional materials, and guest speakers. Launch event costs can vary widely depending on the scale and location of the event, ranging from $10,000 to $100,000 or more.

Maintenance and Support Costs

After the successful launch of your payment app, ongoing maintenance and support are essential to ensure its continued operation and user satisfaction. Here are the key cost components:

- Ongoing Software Maintenance Expenses: Regular maintenance activities such as bug fixes, performance optimization, security updates, and feature enhancements are necessary to keep the app running smoothly. Ongoing software maintenance expenses depend on the complexity of the app and the frequency of updates, typically ranging from $50,000 to $200,000 or more per year.

- Customer Support Costs: Providing responsive and helpful customer support is crucial for addressing user inquiries, troubleshooting issues, and maintaining user satisfaction. Customer support costs include salaries for support staff, training, support tools, and infrastructure. Customer support costs can range from $50,000 to $150,000 or more per year, depending on the size of the user base and support requirements.

- Updates and Upgrades: Implementing updates and upgrades to introduce new features, improve functionality, and address user feedback is essential for the long-term success of your payment app. Costs for updates and upgrades vary depending on the scope and complexity of the changes but typically range from $50,000 to $200,000 or more per year.

How To Generate Revenue Through Building a Payment App Like PayPal?

Every business’s primary goal is to make a profit, or more accurately, to generate income greater than its initial investment. In light of this, creating an investment app that functions similarly to PayPal might prove to be a lucrative venture provided that it yields income.

Therefore, we have outlined a few methods for earning money from the development of Fintech applications similar to PayPal.

Changeover Charges

Charging Interchange Fees on all debit or credit card-based transactions is one way to make money. It’s important to note that charging a price in line with market norms might discourage customers from using your Fintech application.

Fees for Fund Transfer and Payment Processing

You can provide free payment processing up to a specific amount, even though the majority of your rivals charge extremely cheap rates, to get an advantage over the market.

Additionally, a user must pay the regular fees if they wish to pay for transfers of funds that exceed the limit. In this manner, the transactions that your users or merchants do through your application might bring in money for you.

Fee for Cross-Border Payments

By charging a Cross-Border Payment Fee to consumers and businesses who use your Fintech app, such as PayPal, to conduct international transactions, you may also make more money.

Interest Rates for Quick Loans

We hope you recall the functionality we discussed before in this blog post, Instant Loan Lending. The interest you earn from loans you make to users and merchants may be a significant source of income.

Business Account Subscription Fees

A Business Account for Merchants is offered by Paypal and other well-known Fintech applications. After paying a membership fee, merchants may access more capabilities. In a similar vein, charging membership fees for the Business accounts in your Fintech mobile app is another way you may make extra money.

Commissions from Affiliates and Brand Partnerships

Finally, but certainly not least, brand partnerships and affiliate commissions inside your app may bring in a sizable sum of money. With your Fintech app, which functions like PayPal, you can let other firms sell their goods and services and charge them cooperation payments and affiliate fees.

How DianApps Can Help You Build Payment Apps Like PayPal At Affordable Rates?

Custom Development Solutions:

DianApps offers custom development solutions tailored to your specific requirements. Instead of using pre-built templates or generic solutions, they focus on understanding your needs and crafting a payment app that suits your business model perfectly. This approach ensures cost-effectiveness as you only pay for the features and functionalities you need.

Agile Development Methodology:

DianApps follows an agile development methodology, breaking down the project into smaller, manageable tasks called sprints. This approach allows for continuous feedback and iteration, ensuring that the development process remains flexible and adaptable to changes. By avoiding lengthy and rigid development cycles, costs are kept in check, and you have greater control over the budget.

Open Source Technologies:

Leveraging open-source technologies can significantly reduce development costs without compromising on quality. DianApps utilizes open-source frameworks, libraries, and tools to build robust payment apps efficiently. By harnessing the power of community-driven resources, they can streamline development timelines and pass on the cost savings to you.

Scalability and Future-Proofing:

We designs payment apps with scalability and future-proofing in mind. By employing scalable architectures and flexible infrastructure, they ensure that your app can grow seamlessly as your business expands. This proactive approach helps avoid costly redevelopment efforts down the line, making it a cost-effective investment in the long run.

Compliance and Security:

Building payment apps like PayPal requires adherence to strict compliance standards and robust security measures to protect sensitive financial data. DianApps has expertise in navigating regulatory requirements and implementing industry-best security practices. By prioritizing compliance and security from the outset, they mitigate the risk of costly fines, breaches, or legal issues later on, ultimately saving you money in the long term.

That’s a Wrap

The majority of people use PayPal, one of the top mobile applications, to conduct cross-border, digital, and P2P payments in a variety of currencies.

Creating a sophisticated Fintech app that rivals PayPal could be challenging, but with the correct roadmap and knowledgeable development team, you can create a Fintech app that not only offers your users an improved experience and profitability but also poses a competitive edge to PayPal. And who knows, if you play your cards correctly, it may even defeat PayPal.

We hope that this article has given you a thorough understanding of the cost of building a payment app like PayPal Fintech apps.

Hire us as your FinTech app development company for further advice and a professional development team.

Continue Reading: How to speed up Fintech software development in 2024?

Leave a Comment

Your email address will not be published. Required fields are marked *