The creation of personal financial apps is growing in popularity as more individuals want to make the most of their resources, keep tabs on their spending, and maintain stable finances.

For investors and company owners, financial institutions provide substantial opportunities. The personal finance software market is expected to develop at a compound annual growth rate (CAGR) of 5.7% from 2020 to 2027, reaching $1,576.86 million, according to Allied Market Research.

These numbers demonstrate the consistent expansion of the worldwide market for personal financial management, inspiring hope and enthusiasm for upcoming business prospects.

However, how can it win over consumers’ hearts and differentiate itself from the fierce competition among personal financial apps?

In a nutshell, find out what your users need first. You may find a more thorough explanation in this blog.

Head on with the Fintech app development latest trends, features, and more!

Now let’s get started!

Introducing Personal Finance Management App

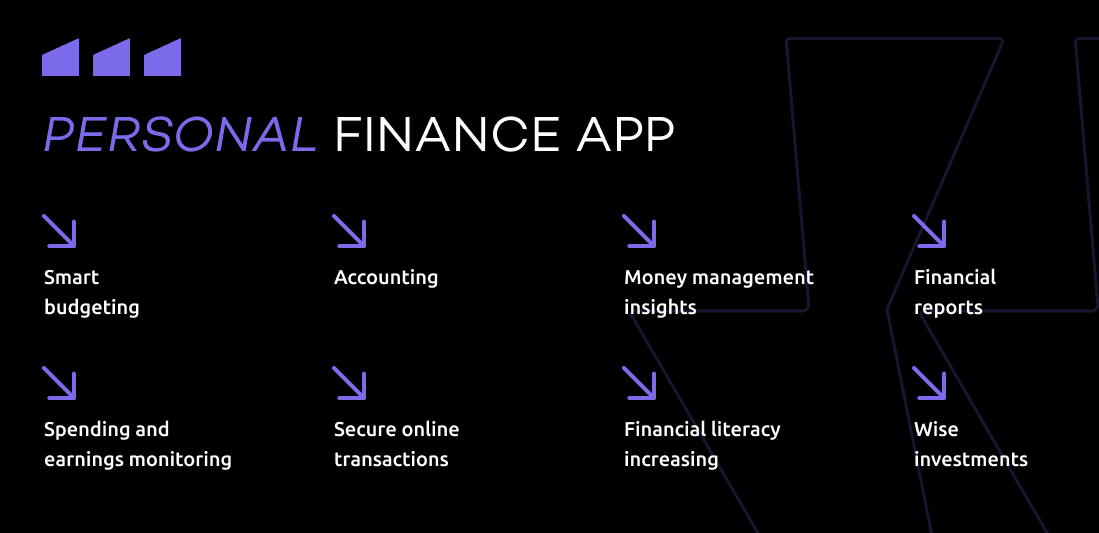

One thing unites all personal finance apps: the ability to manage users’ financial cycles. It is important to remember that a personal finance app should assist the user in tracking their income and outgoings as well as managing their money.

Whether it’s an intricate multipurpose product or basic software, it has to do a few basic tasks:

- Monitoring the equilibrium between revenue and costs

- Analytics can be offered once per a predetermined amount of time.

But these are only the fundamentals. Additionally, you may integrate your finance app with other payment processors to give it other “colors.” Alternatively, you might incorporate gamification features by letting users create objectives related to saving or spending money, and rewarding them with badges when they reach those goals.

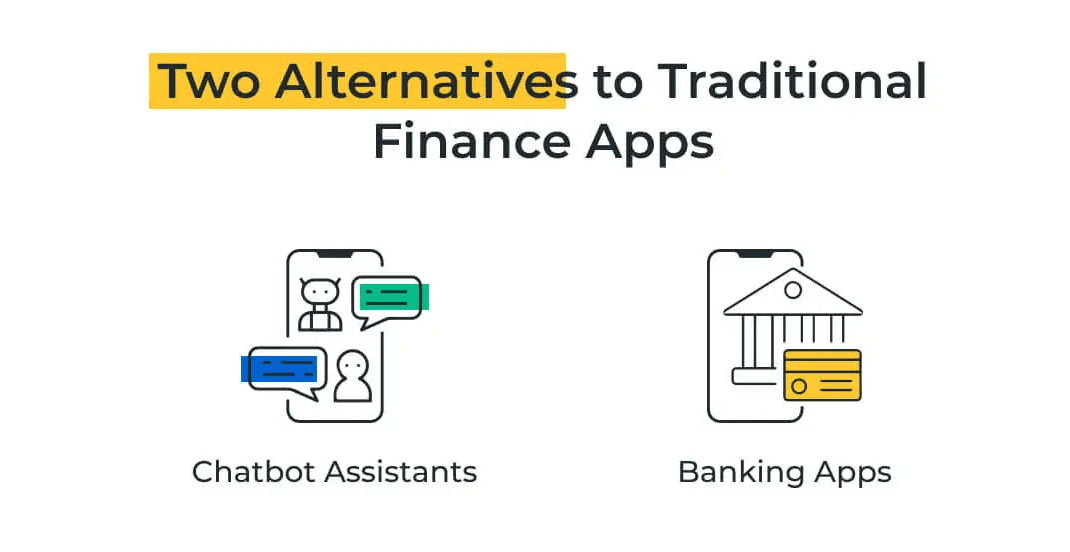

Are There Any Alternatives to Personal Finance Management Apps?

When developing a personal financial app, you have to consider competitors that may not be as visible as your immediate rivals. These two categories of personal finance may take time to become apparent.

Applications for Banking

Unexpectedly, banking applications are starting to appear in the personal finance app market. They become a strong rival that offers banking and finance management capabilities in one location by combining the characteristics of financial analytics and online savings accomplishments.

Assistant Chatbots

It’s interesting to note that there is another rival that isn’t even an app! These chatbots are either included in messaging apps or financial systems. In terms of functionality, they resist giving in to fully complete programs, even though they are parasitic. They offer personalized guidance, aid with option planning, and support with financial management.

What Must Be The Price of Building a Personal Finance App?

Developing a personal financial app typically costs $37,500. Nonetheless, the overall expense may range from $25,000 to $50,000. An app for personal finance that has fewer features—also referred to as a minimum viable product, or MVP—will cost less than one with all of the planned functions.

Hire DianApps Fintech app development services at affordable prices with the best solution package and technology infusion.

How much time does it take to develop an app for personal finance?

Building a personal financial app typically takes 467 hours. On the other hand, the development of a personal financial app might take up to 800 hours or as little as 267 hours. The precise timetable is primarily determined by how complex your particular software is. Generally speaking, if you need really specialized designs, specialized features, intricate logic, or non-standard release platforms, it will take longer.

Feature Incorporation in Your Personal Finance Management App

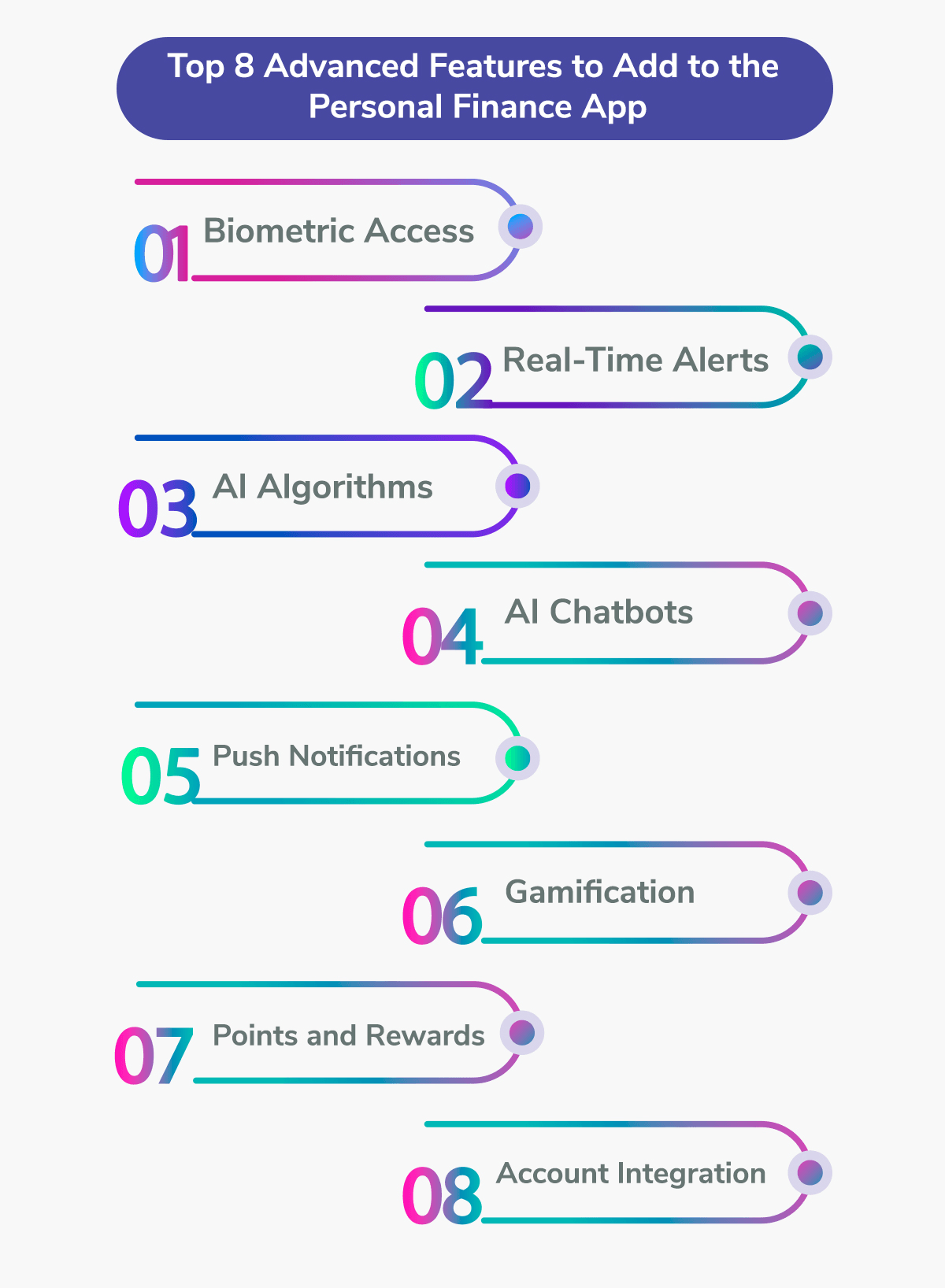

Access via Biometrics

The program may authenticate the user using biometric access, an authentication method. It employs a person’s distinctive characteristics, such speech patterns or fingerprints, for authentication.

Adding this functionality to the app has been standard practice these days in order to bolster security.

Instant Alerts

This feature gives customers access to real-time information in an effort to win their trust. Continue providing alerts about additional information or real-time news to users so they are aware of any updates.

Algorithms for AI

Artificial intelligence is a technology that helps companies get data insights so they can provide people with a more personalized experience. You may provide your app users with a more customized experience by utilizing AI in FinTech App Development.

For instance, the app may alert users when they are overspending in a certain area, like groceries or leisure. Users can also be assisted by graphs that show the costs for several categories.

Chatbots using AI

This is for people who need particular information or who are having trouble using the app. AI chatbots may also provide personalized advice, recommendations, or tips by analyzing consumer data and behavioral trends. It facilitates effective money management.

Push Notifications

You may notify your consumers about deals, news, suggestions, and other information by using push notifications.

Use push alerts to let customers know, for instance, if you are offering a discount on your yearly membership. You might also bring up the bill with them.

Gamification

Gamification is a useful feature to include if you want to increase user engagement. Users of the app may spend more time and enjoy the greatest experience possible.

Points and Incentives

People adore being rewarded for their efforts.

You have the option of rewarding your audience with money, points, discounts, and coupons. This will assist you in maintaining user activity on the app.

Integration of Accounts

All financial data, including that related to credit cards, debit cards, loans, mutual funds, fixed deposits, and other accounts, ought to be included in the app by users. All of the data ought to be trackable with only one app.

Also read: The perks of hiring Fintech app developers from top companies

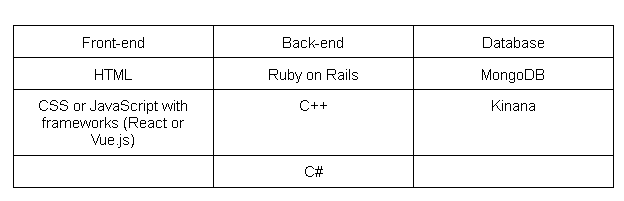

Tech Stack & APIs Needed To Build a Personal Finance Management App

Choose a list of tools and technologies that you will employ to construct the personal finance app when you have a list of features for your budget monitoring app in hand. These might be frameworks, libraries, or programming languages.

The tech stack that would be needed to create a finance app is as follows:

APIs

The feature list and the location of the bank you are cooperating with will determine which APIs you may use to develop your personal financial app.

Users are typically requested to provide personal data from a banking app for personal finance app study.

The Plaid API is the ideal option in this situation.

Also read: Best tech stack for FinTech software development in 2024

Steps To Build A Personal Finance Management Application

Perform Research on Competitors

Knowing who your rivals are and what they are up to is essential. Numerous insights for your app development will be available to you.

Examine the features and functionality offered by the applications of your rivals. You may learn a lot by looking into their monetization goals.

Examining the services they don’t provide to their audience is crucial. Determining their service gap can assist you in choosing the features to include in your app.

Clearly State Why You Are Developing an App.

Why are you developing a personal financial app? This is the response to your query on the creation of a personal financial app.

You will get access to the complete app development roadmap after you have established your objective. At this point, you should also decide what features you want to add to your app and what kind of user data you will require.

Never Undervalue Security

Customers should only provide extremely sensitive financial information to you if your app is completely safe and complies with all government security regulations. Your personal financial app’s security is its most important feature, and making mistakes is never acceptable.

When it comes to data security, compliance agencies like the GDPR and other authorities have certain requirements. You must abide by these rules or risk severe fines and other repercussions, not to mention damage to your brand’s image.

A few security precautions you may want to think about include

- To protect the data, Two-Factor Authentication requires users to provide two different kinds of authentication.

- Also, minimize the session mode, as you have probably seen in banking apps.

- Users’ personal financial information should not be shown on the screen using eye-catching colors and typefaces.

- Observe the rules set out by data security authorities, such as the GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard).

- If you’ve included a chat feature in the app, use data encryption methods.

Specify the Features of Your App

It’s time to make a list of every feature you intend to include in the application. Make a list of every function that a personal financial app needs to have.

You may add features like user registration, profiles, notifications, bank account linkage, computations, reports, investment guides, social network sharing, and the ability to upload reports, among other things.

The Greatest UI/UX Design Designing

A user interface has a significant influence on what users think about and how they respond to your application. For your app, creating the most creative and user-friendly UI requires a major time and financial commitment.

It should be sleek, uncomplicated, incredibly efficient, and visually appealing. The greatest user experience may thus only be attained by you. Select the top designers for the task and let them to use their experience to provide you with the greatest solutions for UI/UX.

Development and Testing of Apps

The real development of the app happens at this stage. Employ knowledgeable mobile app developers who have worked in the field before.

Request that simple features be developed first, followed by complex ones. To guarantee that the app can be completed before the deadline, choose an agile app development methodology.

The testing and debugging process follows. Throughout the development process, quality analysts and developers often collaborate to find and fix faults and mistakes.

Make sure all the features are working properly and that there are no problems or mistakes before launching the app.

Launching The Application

Now that every functional issue has been resolved, it’s time to open the application. It would be prudent to first make the app available to a limited number of users in order to get their input. The software can be improved in accordance with input and comments that you get.

Support and Modification

This completes the process of developing an app. You must make sure that the software is periodically updated and is kept under development by the developers even after it has been deployed.

You never know what problems can occur, so when they do, you must act fast to address them and provide your consumers with a positive experience.

That’s The End

How to create a personal financial app is an issue that we have already addressed. Here, we’ve gone over every aspect, including the price, features, cost breakdown, and other important information.

With a personal financial app, you can simply make money while providing customers with a one-stop shop for effective money management.

Employ a mobile app development firm that specializes in this field and allow them to create a feature-rich, feature-complete, and useful personal financial app for you.

DianApps is a mobile app development company that provides organizations and enterprises with the greatest resources available for employment.

We can provide the greatest talent at the best price, whether you’re searching for a single developer or a committed team of designers, quality analysts, and developers.

Hire professionals for your app development project now.

Leave a Comment

Your email address will not be published. Required fields are marked *