Remember the times, when we used to browse through outdated insurance websites and wait long for the contact person to receive the calls?

Well, that was a time and now it has changed!

The insurance industry is getting to the level of today’s digital age and leveraging the power of technology. As we witness the exponential rise of insurtech and the growing demand for accessible and helpful insurance services, now is the high time for established insurance companies to build a mobile app that not only improves their service offerings but also has the potential to make an impact on the entire industry.

All things considered, many factors might affect your decision to leverage insurance app development services for your business. One such factor is the COST of on-demand insurance app development. Well, it’s a crucial aspect to be carefully assessed.

So, let’s dive into the details!

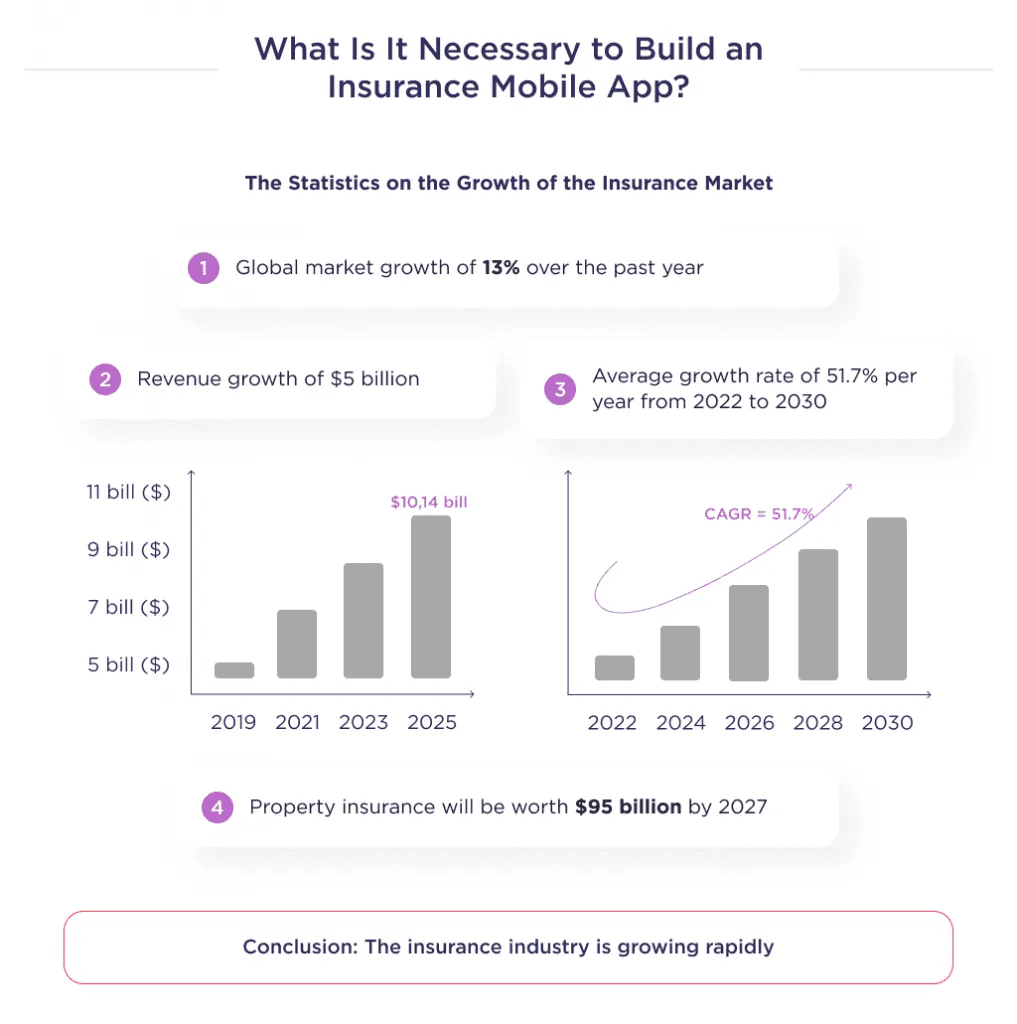

Market Synopsis of Insurance Apps

- The global market growth rate of the Insurance market was marked as 13% in 2023.

- Revenue growth is calculated as $5 billion.

- According to GlobalData’s report forecasts, a 10.1% increase in 2023 after a rise of 10.9% in 2022.

- The average growth rate of the insurance market is predicted to be around 51.7% per year from 2022 to 2030.

- Insurtech Market to be Worth $152.43 Billion by 2030

- Property insurance will be worth $95 billion by the end of 2027.

Cost to Develop an Insurance App

Determining the exact cost of building an insurance app like Trōv and Verifly can be challenging due to various factors influencing mobile app development costs. These factors include app complexity, target platforms (e.g., iOS, Android), device compatibility, geographic location, development team expertise, choice of design and development tools, and additional features.

Generally, there are four categories for on-demand insurance app development, each with its cost implications.

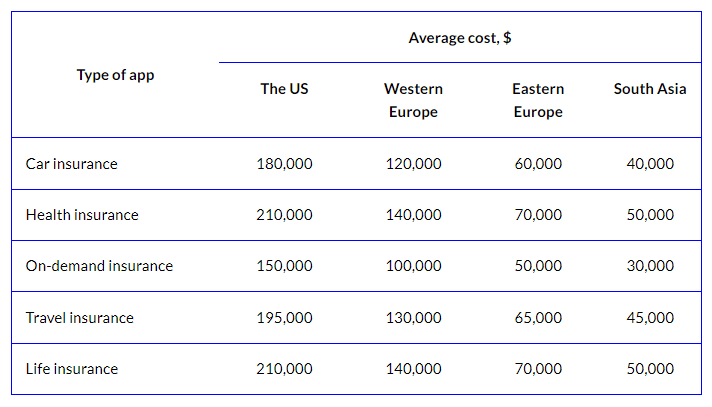

Cost by App Type

1. Car Insurance App

Given the fact that the majority of US drivers spend a significant amount on auto insurance annually, developing a car insurance app helps you knock on the doors of the most lucrative market. Estimated at $60,000, the cost may vary depending on complexity. Features like service listings, pricing algorithms, claims filing, and geolocation enhance user experience, akin to platforms like Cuvva.

2. Health Insurance App

With an annual revenue of $1 trillion in the US alone, the health insurance market presents a profitable opportunity. Building a comprehensive health insurance app, such as Care Health, costs approximately $70,000. The features include plan coverage checks, claims filing, ID card access, provider search and contact, and account balance checks.

3. On-demand Insurance App

On-demand insurance apps offer flexible coverage, allowing users to activate or deactivate policies as needed. With development costs estimated at $50,000, features include plan listings, payment gateways, geolocation services, and in-app messaging. Metromile as an example, of the car insurance niche.

4. Travel Insurance App

With the global travel insurance market witnessing CAGR of 26.1%, developing an all-inclusive travel insurance app like Goose presents a lucrative opportunity. Estimated at $65,000, such an app should include essential features like travel guides, service listings, in-app mapping, chat functionality, language translation, claims tracking, and more, fulfilling the diverse needs of travelers.

5. Life Insurance App

With over half of Americans holding a life insurance policy, developing a dedicated life insurance app like National Life offers a lucrative opportunity. Such a custom full-service app typically requires an investment of $70,000. Essential features include policyholder profiles, policy lists, usage tracking, in-app payments, chat functionality, and more, catering to the needs of policyholders.

Cost by App Complexity

1. Simple

Simple on-demand insurance applications are ideal for creating minimum viable products (MVPs) due to their basic feature set. They typically feature a straightforward user interface and are designed for a single platform. Development costs for such apps typically range from $30,000 to $120,000. However, actual costs may vary depending on specific requirements and project specifications.

2. Medium

Medium complex on-demand insurance applications present more development challenges. They incorporate sophisticated features like in-app chat support, payment gateway integration, and custom UI designs. Consequently, the cost for developing such apps typically falls between $120,000 to $300,000. However, actual expenses can vary based on specific project requirements and complexities.

3. Complex

Custom on-demand insurance app development entails high-level advanced features like geolocation, BI tools, analytics, and predictive market forecasting. These apps are designed to streamline business processes and typically cost between $300,000 to $450,000. However, for an accurate cost breakdown resembling Trōv, consulting with your on-demand app development company is recommended.

Cost by Region

Cost by Team type

1. In-house

The in-house team model involves hiring developers as full-time employees, ensuring close communication, understanding of company goals, and control over the development process. Sensitive data remains within the startup environment. However, it’s financially demanding with obligations like taxes and employee benefits. Restrictive labor laws limit flexibility in reducing or terminating staff, and hidden costs such as office maintenance add to expenses.

2. Local Agency

Local agencies offer smooth cooperation and legal recourse within the startup’s jurisdiction, benefiting from cultural and time zone similarities. However, startups in high-income countries face exorbitant costs for development with local agencies. This expense can be prohibitive, prompting consideration of more cost-effective alternatives.

3. Freelance Team

Freelance developers bring diverse experience and cost-effectiveness to mobile app development projects. However, they pose risks such as project abandonment for better offers and potential data security concerns. While cheaper, freelance teams may not provide the level of security required for sensitive user data handled in insurance apps. Thus, outsourcing agencies present a more reliable and cost-efficient option for insurance mobile app development.

4. Outsource Agency

Outsourcing to software development agencies outside the home country offers startups scalability, quality, and cost-effectiveness, with access to a diverse talent pool and deep developmental insights. However, challenges include communication gaps due to time zone differences and potential misunderstandings arising from cultural differences, particularly in partnerships between Western-based startups and agencies in regions like Africa and Southeast Asia.

Why Should You Invest in On-demand Insurance App Development?

Benefits to Insurance Companies

1.Integration of the latest IT automation tools in insurance apps streamlines processes, reducing workload and paperwork for companies.

2. The expanding user base of insurance mobile apps offers companies access to a vast customer pool, enhancing market reach and potential.

3. Insurance apps serve as convenient mediators between users and service providers, facilitating seamless communication and access to services anytime, anywhere.

4. Users benefit from accessing exclusive offers and personalized recommendations through the app, enhancing their overall experience.

5. Feedback mechanisms within the app enable clients to provide insights on services and agents, aiding companies in enhancing service quality and ensuring customer satisfaction.

Benefits to Users

1. Insurance mobile apps offer user-friendly interfaces, ensuring accessibility for all users, regardless of their technological proficiency.

2. Real-time notifications keep users informed about offers and discounts.

3. Additionally, users can access information about nearby insurance providers, avail of online consultations, and utilize geolocation features for agent assistance.

4. The app also provides step-by-step instructions in case of emergencies, enhancing user experience and convenience.

Key Considerations Before Developing an Insurance App

1. Ensure Legal and Regulatory Compliance

InsurTech, similar to FinTech, is subject to regulation by various organizations depending on the country. To ensure legal compliance regardless of location, startups should consult legal experts, maintain HR specialists versed in labor laws, establish in-house compliance teams, and partner with development firms to ensure robust data protection measures.

2. Have a Marketing Budget

For startups in the InsurTech sector, neglecting marketing in favor of product development can lead to failure. It’s crucial to allocate a sufficient budget to marketing, reflecting business goals and ensuring the implementation of effective strategies to reach the target market. A recommended guideline is to allocate 2-3 times the development budget to marketing annually, ensuring adequate resources for user acquisition and growth.

3. Validate Your Business Idea

Effective product development begins with clarity. Articulate the type of insurance app, target audience, and desired outcomes clearly. Conduct observation sessions, discuss functionalities like biometric authorization and chatbots, and gather feedback from the target market to ensure alignment with user needs and preferences.

You may also like to read about: Things You Need To Know About FinTech Software Development.

Top Insuretech trends to watch out in 2024

1. App Localization

App localization expands the reach of on-demand insurance apps beyond specific regions or countries, increasing accessibility to a wider audience. This strategy not only boosts app downloads but also improves brand reputation by catering to diverse markets and enhancing user experience.

2. Top KPIs

The success of an on-demand insurance app relies on key performance indicators (KPIs) such as client base stability, income efficiency of customers, and processing acceleration. These balanced KPIs drive productivity and growth, ensuring the realization of initial app ideas.

3. SMEs and User Protection

In the field of financial technology trends, cybersecurity is extremely important for safeguarding user protection, ensuring customer retention, and fostering profitable cooperation. Conversely, SMEs necessitate protection against bad debt write-offs and non-payments. Reliable on-demand insurance app development teams offer crucial support, saving businesses from potential setbacks.

4. Introduction of Blockchain and AI

AI in Fintech App Development, especially when it comes to the insurance sector, goes beyond chatbots, offering personalized options through predictive analytics. Blockchain ensures transparency and security for sensitive consumer data, enhancing trust and data integrity within insurance applications.

How can you Generate Revenue from On-demand Insurance Apps?

1. Subscription Model

On-demand short-term insurance apps adopt a subscription-based model to generate revenue. Users pay a recurring fee to access premium features for a set duration. This strategy ensures steady income as users renew their subscriptions periodically to maintain access to the app’s benefits.

2. Advertising Model

Most of the on-demand insurance apps make money by allowing other companies to publish their advertisements on their platform.

3. Referral Marketing

On-demand insurance platforms leverage referral marketing to boost downloads and revenue by incentivizing users to share the app. While effective now, future success depends on adapting to millennials’ preferences for integrated technology and traditional insurance solutions.

4. Commission Model

Aggregator apps often adopt a commission-based model, allowing users to compare various insurance options and select the most suitable policy. These apps earn commissions from both insurance companies and users for facilitating the selection process and connecting them with the right policies.

Top Insurance Apps to Take Inspiration

1. Esurance Mobile

Esurance Mobile introduces a sleeker, more intuitive design for modern users. With simplified navigation, quick access to policy info, roadside assistance, and ID cards, it offers seamless management of insurance tasks, claims, repairs, and more, all in one place.

2. Lemonade Insurance

Lemonade offers hassle-free insurance starting at low monthly rates, with policies available in just 90 seconds via their user-friendly app. With a focus on social good and innovative features like instant claims and adjustable coverage, Lemonade stands out in the insurance industry.

3. Cuvva

With the Cuvva app, you can easily get covered in minutes and drive any car, whether you own it or borrow it. From short-term policies for road trips to borrowing a friend’s car, Cuvva offers flexible coverage options and convenient management features right from your phone.

4. TravelSmart

TravelSmart App is a Vietnamese travel platform offering a wide range of package tours from various departure points. With user-friendly features like tour search, reliable references, convenient payment options, and a vibrant community sharing travel experiences, it’s your ultimate travel companion.

How can DianApps help you in Insurance App Development?

DianApps is a top-notch on-demand app development company that offers applications packed with features that perfectly aligns with your custom business needs. We specialize in designing, developing, and deploying custom insurance apps on the desirous timelines. Our suite of Fintech app development solutions include

- Social Media Integrations

- Wealth Management Software Development

- Crowdfunding Portal Development

- P2P Lending Software

- Alternative Financing Solutions

- Custom FinTech Software

- Loan Management Software

- mPOS (Mobile Payments) and more.

For detailed information, you may go through our portfolio and reviews on Clutch to know more about our experience in building high-quality fintech products.

That’s a wrap!

In this article, we’ve provided comprehensive insights into insurance app development costs and their importance. With the insurance sector burgeoning, businesses are eyeing lucrative investment opportunities.

Take a moment to make an impressive entry with a proficient Hybrid app. Simply go through the aforementioned points and hire a top-tier fintech software development company to guide you every step of the way.

Leave a Comment

Your email address will not be published. Required fields are marked *