What if you could manage your banking, investments, groceries, subscriptions, bill payments, and even health tracking all within one single app?

In Australia, this futuristic convenience is becoming a reality faster than you might expect. With startups like Clever and Douugh leading the charge, the idea of an all-in-one digital platform or “super app” is no longer confined to Asia’s tech-savvy giants. It’s here, growing steadily in the southern hemisphere, reshaping how Australians engage with digital services.

As consumer expectations shift towards integrated, personalized, and time-saving platforms, super app development is emerging as a strategic frontier for forward-thinking businesses.

Let’s dive deep into how Clever and Douugh are setting the tone, the market dynamics fueling this trend, and why now is the time to consider building a super app in Australia.

What Exactly Is a Super App?

A super app is a single mobile application that provides access to a wide variety of services financial, commercial, social, and lifestyle, all in one ecosystem. Think of it as a Swiss army knife of apps.

Popularized by WeChat in China and later mirrored by apps like Grab and Gojek in Southeast Asia, the super app concept has now arrived in Australia with localized innovation and regulatory support.

Core Characteristics of a Super App:

- One login for multiple services

- Unified UI/UX across modules

- Seamless cross-service data sharing

- Secure cloud infrastructure

- Modular design for scalability

In short, it’s not just an app; it’s a platform that connects the dots between different user needs.

Why Super Apps Are Gaining Ground in Australia

1. Mobile-First Population

Over 88% of Australians own a smartphone. The demand for mobile convenience is soaring, especially among millennials and Gen Z. These users are accustomed to doing everything from banking to booking a workout in just a few taps.

2. Fintech-Led Innovation

Australian startups are disrupting the traditional financial space with apps that go beyond banking. Clever and Douugh are perfect examples of fintech brands evolving into lifestyle solutions leveraging AI, big data, and open banking.

3. Open Banking & CDR Compliance

Thanks to the Consumer Data Right (CDR), users can securely share their financial data across platforms. This open access allows developers to integrate multiple banking and budgeting tools into a single platform, giving rise to smarter super apps.

4. Rising Demand for AI-Powered Automation

Users no longer want to manually manage subscriptions or budget spreadsheets. They want AI to alert them when spending exceeds a threshold, or when bills are due, all in real-time. Super apps enable this smart automation.

Also read: AI app development in Australia– Key Features, Costs, and Process

The Trailblazers: Clever and Douugh

Douugh – The AI-Powered Financial Wellness App

Douugh markets itself as more than a bank. It’s a financial wellness platform powered by AI that automatically helps users save, invest, and budget more effectively.

Key Features:

- Smart Bills jar for automated expense allocation

- Investment opportunities, including crypto and stocks

- Real-time financial health tracking

- AI insights for goal-based saving

Douugh is not just about transactions. It’s about giving users a full picture of their financial wellbeing, and the tools to improve it without switching platforms.

Clever – The One-Stop Financial Hub

Clever offers Australians a centralized dashboard for daily money management. It integrates bank accounts, savings, investments, and even superannuation data in a single app.

Key Features:

- Visual budgeting and forecasting

- AI-powered cash flow analysis

- Smart alerts for unusual spending

- Custom investment options based on user goals

By focusing on simplicity and financial literacy, Clever is turning complex financial decisions into guided, gamified experiences, a core hallmark of successful super apps.

Super Apps Go Beyond Finance

While fintech dominates the narrative, super apps are not limited to banking or money management. In Australia, we’re starting to see a broader expansion into:

- Healthcare: Appointment booking, telehealth, medical records

- Mobility: Rideshare, electric scooter rentals, public transport cards

- Lifestyle: Fitness coaching, meditation, nutrition tracking

- Retail: E-commerce, loyalty programs, AR-based try-ons

Super apps are gradually becoming ecosystems of everyday life, not just tools for one domain.

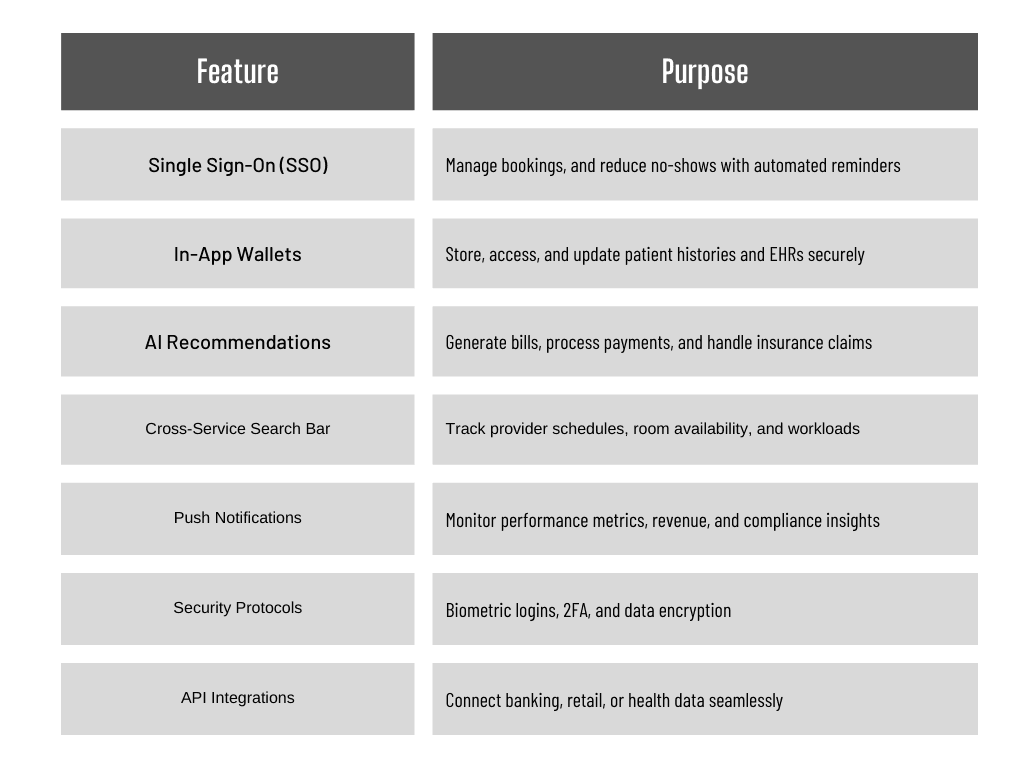

Must-Have Features for a Super App in 2025

If you’re planning to build a super app, consider integrating these key functionalities:

What’s Next for Super Apps in Australia?

The future looks promising. With 5G adoption, AI advancements, and the rise of decentralized digital identities, super apps are expected to evolve into even more intelligent, secure, and hyper-personalized ecosystems.

We anticipate:

- Voice-powered transactions

- AR/VR integrations for shopping and education

- Decentralized finance (DeFi) modules

- Predictive healthcare monitoring

And as users continue to demand “everything now, in one place”, companies that fail to adapt will struggle to compete.

Should Your Business Build a Super App?

If your current mobile app serves just one purpose, it’s time to rethink your app strategy.

Whether you’re in retail, healthcare, banking, or logistics, a super app opens doors to:

- Higher user retention

- Cross-service monetization

- Better data analytics

- Stronger brand loyalty

All you need is a custom software development company with experience in multi-module architecture, regulatory compliance, and next-gen UX.

Final Thoughts: Australia’s Super App Moment Is Here

From Clever’s data-driven budgeting to Douugh’s AI-powered banking, the super app wave in Australia is just getting started. These startups are not only changing the way we use apps, they’re reshaping the future of digital engagement.

If you’re a business looking to lead rather than follow, investing in custom super app development services is your next big move.

Don’t just build an app. Build an experience.

Ready to Build a Super App? Let’s Talk.

At DianApps, we specialize in mobile app development services in Australia, from ideation to launch. Whether you want to replicate the success of Douugh or create the next Clever, we’re here to help you design, develop, and scale your super app.

Contact us today for a free consultation.

Leave a Comment

Your email address will not be published. Required fields are marked *